What The Fed Might Do After The July 2023 Cpi Report Seeking Alpha

What The Fed Might Do After The July 2023 Cpi Report Seeking Alpha July 2023 consumer price inflation gained 0.2%. cpi for all urban consumers gained 0.2% y y and is the same as the june increase. the annual core cpi increased by 4.7%, below the 4.8% expectations. Expect the july cpi data to show a disinflation trend, increasing the chances of the fed cutting interest rates in september 2024. nowcast predicts july cpi to increase by 0.24%, with prices.

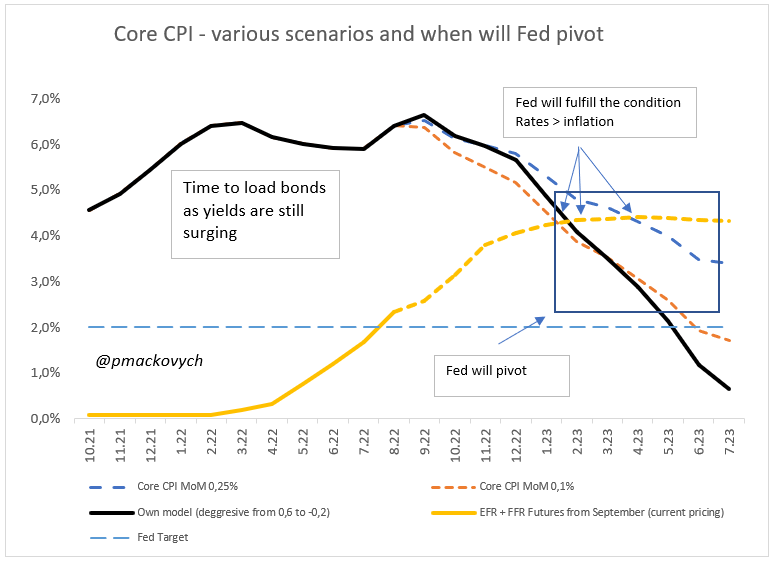

Inflation Scenarios Reveal Fed Will Likely Pivot In Q1 2023 Seeking Alpha From yardeni: "august's headline and core cpi inflation rates increased 0.6% and 0.3% m m. they rose 3.7% and 4.3% y y, which still seem to be too hot considering that the fed's inflation target. In the first half of 2023 a lot of high inflation figures left the series. march, may and june 2022 all saw cpi inflation rise more than 1% in each month. as those high numbers have rolled out of. There are three possibilities for what the fed might do moving forward, according to economists: a second consecutive rate hike in september, one in november, or no more rate hikes after july. The fomc has maintained the target range for the federal funds rate at 5 1 4 to 5 1 2 percent since its july 2023 meeting. the committee views the policy rate as likely at its peak for this tightening cycle, which began in early 2022. the federal reserve has also continued to reduce its holdings of treasury and agency mortgage backed securities.

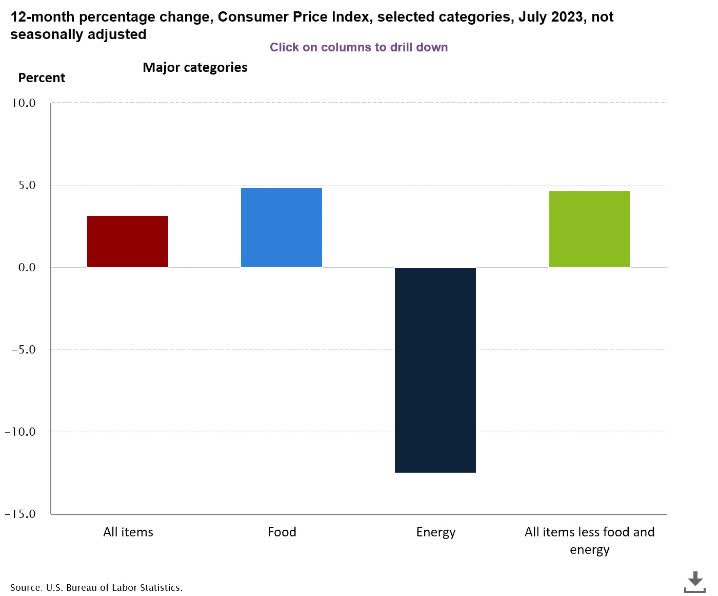

What The Fed Might Do After The July 2023 Cpi Report Seeking Alpha There are three possibilities for what the fed might do moving forward, according to economists: a second consecutive rate hike in september, one in november, or no more rate hikes after july. The fomc has maintained the target range for the federal funds rate at 5 1 4 to 5 1 2 percent since its july 2023 meeting. the committee views the policy rate as likely at its peak for this tightening cycle, which began in early 2022. the federal reserve has also continued to reduce its holdings of treasury and agency mortgage backed securities. The consumer price index climbed 3.2 percent in the year through july, according to a report released on thursday. for the fed, the july inflation report could prove more difficult for the. This was the first time since march 2021 that 12 month increase was below 3.0 percent, when prices rose 2.6 percent. food prices rose 2.2 percent from july 2023 to july 2024, compared with increases of 4.9 percent from july 2022 to july 2023 and 10.9 percent from july 2021 to july 2022. read more ».

Comments are closed.