What Is A Yield Curve

Yield Curve Basics How To Read The Bond Market Britannica Money A yield curve is a line that shows the interest rates of bonds with different maturities. it can indicate the direction of interest rates and the economy. learn about normal, inverted, and flat yield curves and how to use them. A yield curve is a visual tool that shows how bond yields change with maturity. learn about the different types of yield curves, how they reflect market conditions and the economy, and what factors affect them.

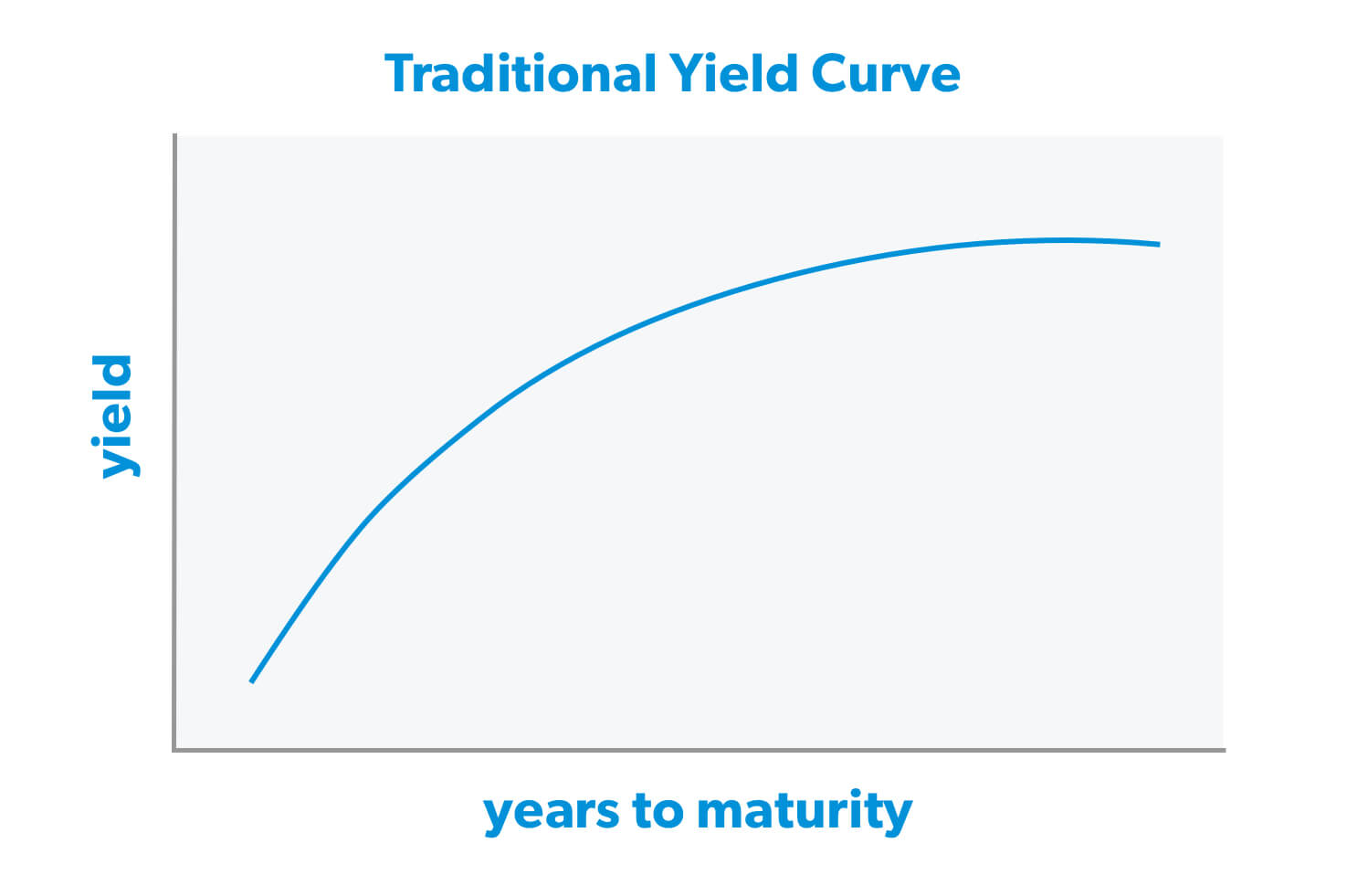

What Is A Yield Curve Ramsey The yield curve is a visual representation of how much it costs to borrow money for different periods of time; it shows interest rates on u.s. treasury debt at different maturities at a given. The yield curve is a line graph showing interest rates of bonds with different maturity dates. it can be an important economic indicator of future interest rate changes and the health of the economy. learn about the four types of yield curves and how they relate to recessions. A yield curve is a graph of interest rates on debt for different maturities. it shows the yield an investor can expect to earn by lending his money for a given period of time. learn about the different shapes, influencing factors, importance and theories of the yield curve. The bond yield curve shows the relationship between bond yields and maturity dates. it can indicate the direction of the economy and inflation, and help investors make financial decisions. learn about the normal, steep, flat and inverted yield curves and how they affect the market.

Yield Curve Economics Interest Rates Bond Markets Britannica Money A yield curve is a graph of interest rates on debt for different maturities. it shows the yield an investor can expect to earn by lending his money for a given period of time. learn about the different shapes, influencing factors, importance and theories of the yield curve. The bond yield curve shows the relationship between bond yields and maturity dates. it can indicate the direction of the economy and inflation, and help investors make financial decisions. learn about the normal, steep, flat and inverted yield curves and how they affect the market. A yield curve is a graph of bond yields by maturity, reflecting investors' risk perceptions and expectations. learn about the normal, steep, inverted, flat, and humped yield curves, and how they indicate the state and direction of the economy. In finance, the yield curve is a graph which depicts how the yields on debt instruments – such as bonds – vary as a function of their years remaining to maturity. [1][2] typically, the graph's horizontal or x axis is a time line of months or years remaining to maturity, with the shortest maturity on the left and progressively longer time.

:max_bytes(150000):strip_icc()/dotdash_Final_The_Predictive_Powers_of_the_Bond_Yield_Curve_Dec_2020-03-2eb174d7c61d4bca88aaaa03b0dba479.jpg)

The Predictive Powers Of The Bond Yield Curve A yield curve is a graph of bond yields by maturity, reflecting investors' risk perceptions and expectations. learn about the normal, steep, inverted, flat, and humped yield curves, and how they indicate the state and direction of the economy. In finance, the yield curve is a graph which depicts how the yields on debt instruments – such as bonds – vary as a function of their years remaining to maturity. [1][2] typically, the graph's horizontal or x axis is a time line of months or years remaining to maturity, with the shortest maturity on the left and progressively longer time.

Comments are closed.