What Is A Good Credit Score For A Mortgage In The Uk Youtube

What Is A Good Credit Score For A Mortgage In The Uk Youtube You could be looking at getting the best mortgage rates if you have an excellent credit rating, the cutoff for this being between 916 999, 466 700, or 628 710 by experian’s, equifax’s, and transunion’s standards, respectively. on the other hand, if your credit score is between 0 560, 0 279, or 0 550 by the same token then you can expect. The experian credit score is based on the information in your experian credit report. it runs from 0 999 and can give you a good idea of how lenders are likely to view you. the higher your score, the better the chance you have of getting the mortgage you’re after. this table is a general guide to how lenders may see you, based on your.

What Is A Good Credit Score For A Mortgage Uk Shine Mortgages As credit agencies each use different scoring systems, no specific score guarantees you a mortgage. nonetheless, the higher you score, the better. for experian, a score of 881 960 is considered good, while 420 465 is considered good for equifax. transunion states that 604 627 indicates a good credit score. Experian’s system ranges from 0 999, and anything below 721 is considered poor. transunion scores borrowers from 0 710 (for some reason) and also has five ‘rating’ bands (with five being the best and one the worst), and any score less than 566 (which is the bottom of band 3) is considered poor. equifax has a scale which runs from 0 700. Where the scoring criteria is different between each cra, it always pays to keep a close eye on each cra as its likely that a lender will check one or more of these during the mortgage application process. here are the most up to date score ranges for the most popular credit reference agencies: equifax 0 1000 (previously 0 700) experian 0 999. We’ve shown these ranges below. you’re much more likely to be approved for a mortgage if you have a credit score that is “good” or “excellent”. if your credit rating is “fair”, you should also be eligible for a mortgage provided the rest of your application is up to scratch. however, if you have a “poor” or “very poor.

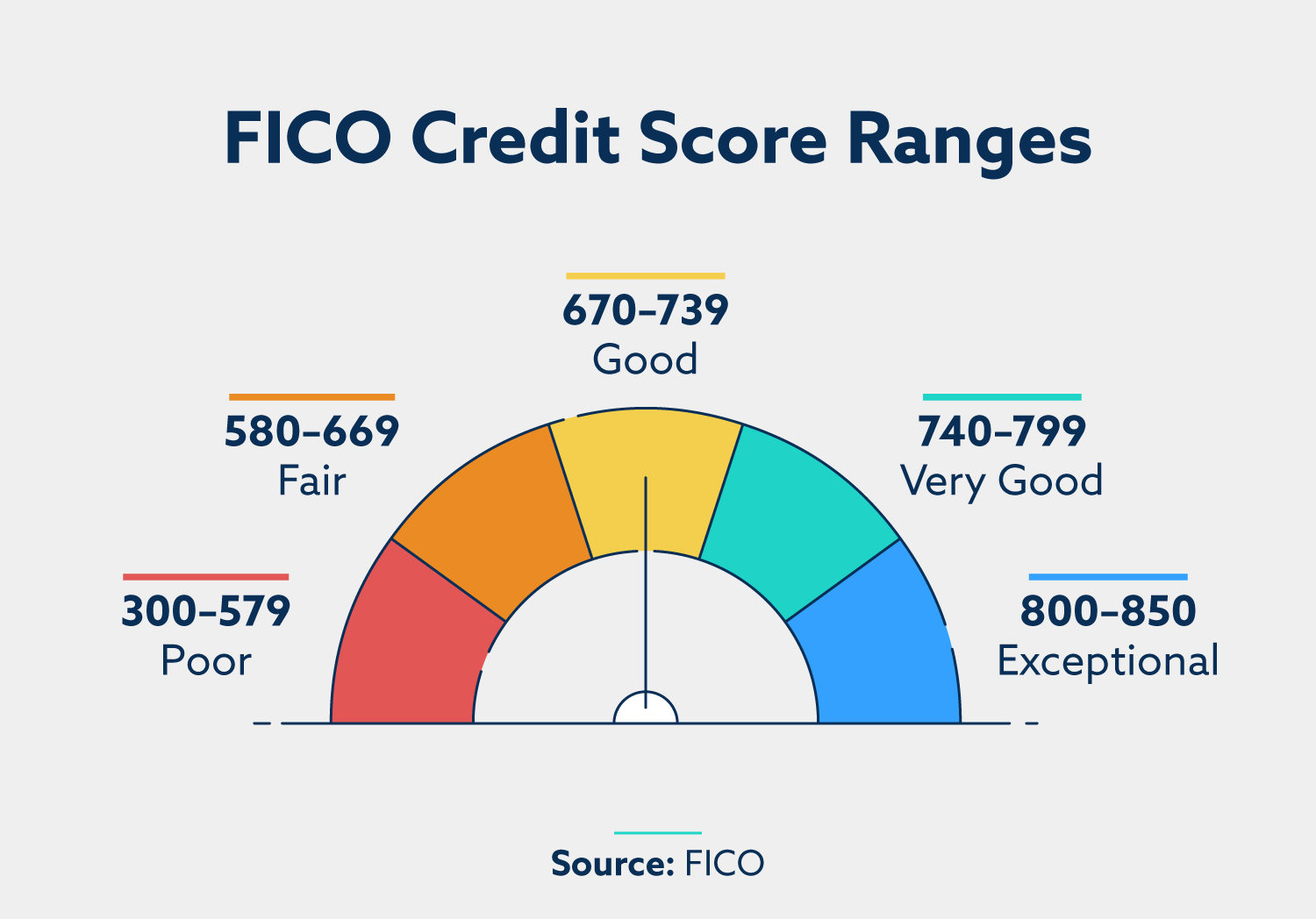

What Is A Good Credit Score To Buy A House Or Refinance Where the scoring criteria is different between each cra, it always pays to keep a close eye on each cra as its likely that a lender will check one or more of these during the mortgage application process. here are the most up to date score ranges for the most popular credit reference agencies: equifax 0 1000 (previously 0 700) experian 0 999. We’ve shown these ranges below. you’re much more likely to be approved for a mortgage if you have a credit score that is “good” or “excellent”. if your credit rating is “fair”, you should also be eligible for a mortgage provided the rest of your application is up to scratch. however, if you have a “poor” or “very poor. As a general rule, the higher your credit score, the lower risk you appear to potential lenders (and the better chance you have of being accepted for products such as credit cards, mortgages and loans). a high credit score suggests that you've handled money and credit responsibly in the past – and are likely to continue to do so in the future. There isn’t a specific credit score that you need for a mortgage, but the higher your score the more likely your application will be accepted. this is because having a higher score makes you a lower risk, and suggests that you are more likely to be able to keep up with the repayments. if you have any outstanding debt, or have struggled in the.

Credit Score Look Up 2023 Understanding Your Credit Score As a general rule, the higher your credit score, the lower risk you appear to potential lenders (and the better chance you have of being accepted for products such as credit cards, mortgages and loans). a high credit score suggests that you've handled money and credit responsibly in the past – and are likely to continue to do so in the future. There isn’t a specific credit score that you need for a mortgage, but the higher your score the more likely your application will be accepted. this is because having a higher score makes you a lower risk, and suggests that you are more likely to be able to keep up with the repayments. if you have any outstanding debt, or have struggled in the.

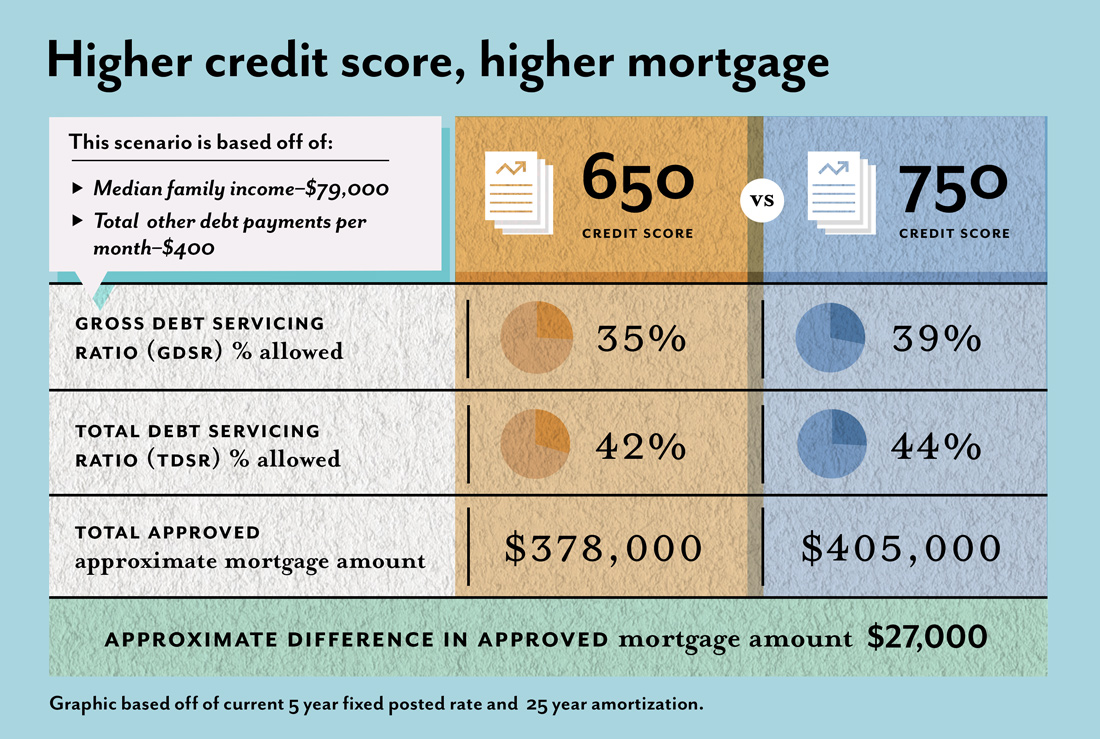

Credit Scores Determine Your Mortgage Amount Ratespy

Comments are closed.