Understanding The Yield Curve Charles Schwab

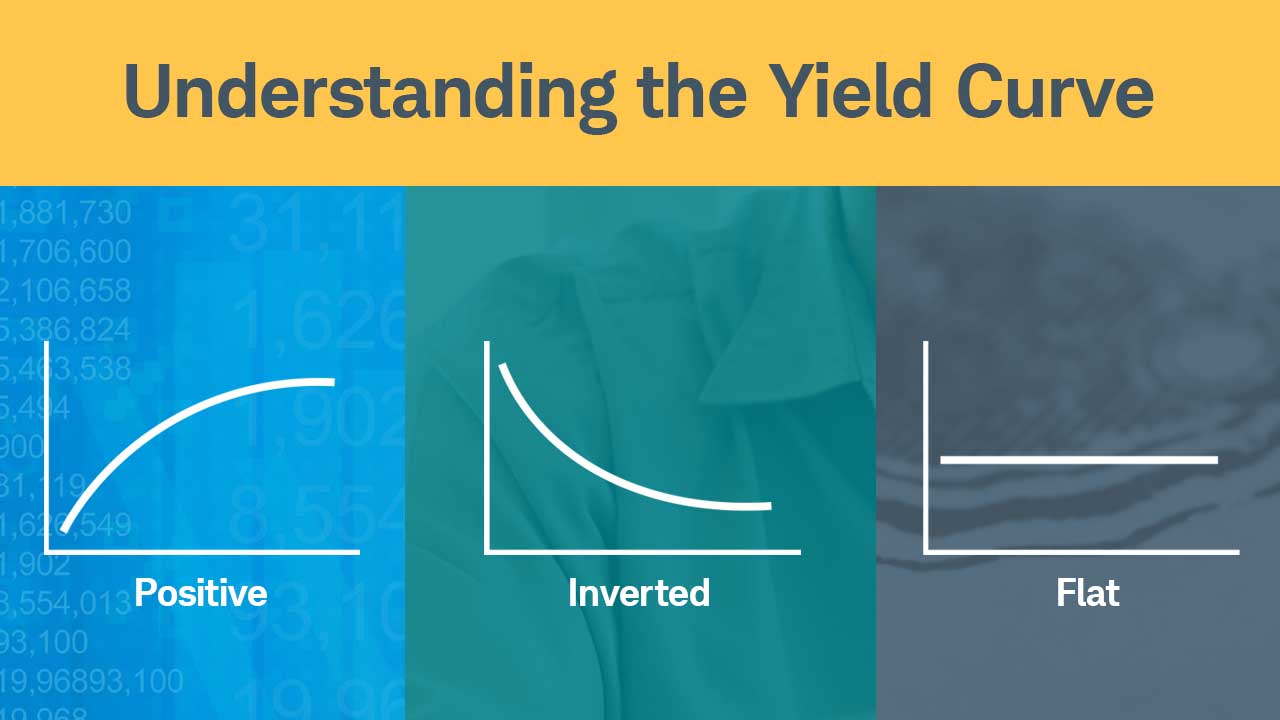

Understanding The Yield Curve Charles Schwab That’s because the actual shape of the yield curve can help provide insight into the future of interest rates. the yield curve has three shapes: upward sloping, or positive, downward sloping, or inverted, and flat. a positive, upward sloping yield curve occurs when yields of shorter maturities are lower than yields of longer maturities. The yield curve is a line graph showing interest rates of treasurys or other bonds with different maturity dates. it can be an important economic indicator. charles schwab. understanding.

.png)

Yield Curve Slope And Recessions Charles Schwab 1978 2020 Your Collin martin joins kathy jones for a conversation with winnie cisar from creditsights. they discuss the role of corporate bonds and how credit ratings work. they cover topics such as the role of credit analysts, factors supporting corporate bonds, concerns about low spreads in the market, attractive and worrisome sectors, the role of private. What you can do next. want to talk about your fixed income portfolio? call a schwab fixed income specialist at 877 566 7982, visit a branch or find a consultant. explore schwab’s views on additional fixed income topics in bond insights. To calculate it, divide the tax exempt bond's current yield by (1 – your federal tax bracket). for example, if you're in the 32% tax bracket, to match the tax benefits of a tax exempt bond yielding 3.50%, you would need a taxable bond yielding 5.15%, or 3.5 ÷ (1 – 0.32). what to know: tax equivalent yield is the easiest way for investors. Its banking subsidiary, charles schwab bank, ssb (member fdic and an equal housing lender), provides deposit and lending services and products. access to electronic services may be limited or unavailable during periods of peak demand, market volatility, systems upgrade, maintenance, or for other reasons. what is the yield curve, and why does it.

Blue Red And Grey Yield Curve Inversions Charles Schwab To calculate it, divide the tax exempt bond's current yield by (1 – your federal tax bracket). for example, if you're in the 32% tax bracket, to match the tax benefits of a tax exempt bond yielding 3.50%, you would need a taxable bond yielding 5.15%, or 3.5 ÷ (1 – 0.32). what to know: tax equivalent yield is the easiest way for investors. Its banking subsidiary, charles schwab bank, ssb (member fdic and an equal housing lender), provides deposit and lending services and products. access to electronic services may be limited or unavailable during periods of peak demand, market volatility, systems upgrade, maintenance, or for other reasons. what is the yield curve, and why does it. Across the yield curve for munis, they ' ve increased about 50 to 60 basis points. that ' s less so than treasury. so across the yield curve for treasuries, they ' re up about 70 to 80 to 80 basis points. now, there ' s good and bad about that. the bad side of it is that it ' s resulted in negative total returns. that tends to be relatively. This site is published by charles schwab, hong kong, ltd. and has not been reviewed by the securities and futures commission of hong kong. charles schwab, hong kong, ltd. is registered with the securities & futures commission ("sfc") to carry out the regulated activities in dealing in securities and advising on securities under registration ce.

Comments are closed.