The Fed S Balancing Act Navigating Rate Cuts And Economic Stability In

The Fed S Balancing Act Navigating Rate Cuts And Economic Stability In That was the first dissent from a fed governor since 2005. fed officials also penciled in more rate cuts by year’s end in their latest economic forecasts, compared to the single cut in 2024 that. On september 18, 2024, the federal reserve cut interest rates by 0.5%, bringing the federal funds rate down to a range of 4.75% to 5%. this move, aimed at managing inflationary pressures while addressing the gradual rise in unemployment, underscores the fed’s balancing act between fostering economic growth and taming inflation.

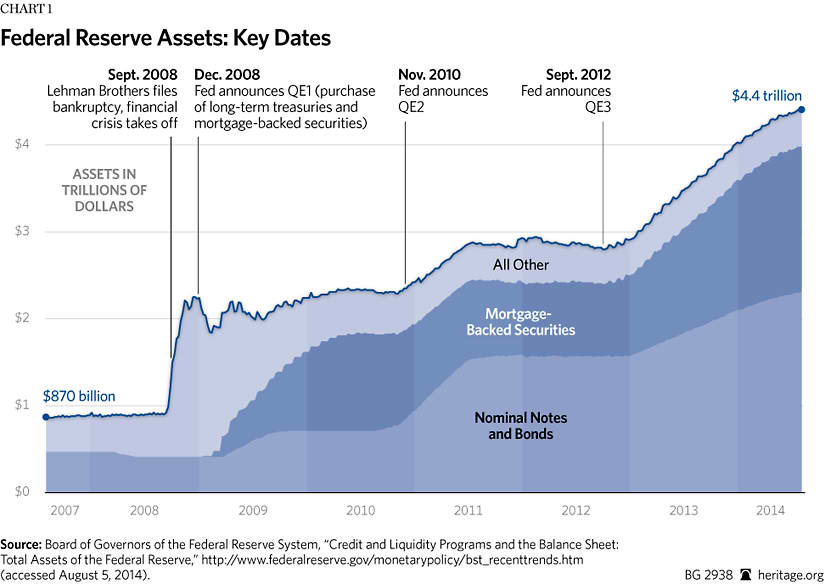

Quantitative Easing юааthe Fedюабтащюааsюаб юааbalanceюаб Sheet And Central Bank Now that the fed has slowed inflation from its 9.1% peak in june 2022 t o 3.4% in december 2023, all while the unemployment rate stayed below 4%, officials appear to have landed on a goldilocks. The federal reserve is now in a balancing act — it doesn’t want to hold rates too high for too long, causing a severe economic slowdown; but it doesn’t want to cut rates too soon, allowing inflation to settle above the fed’s 2.00% goal. the central bank’s shift in focus is twofold — deciding when to start cutting rates and how quickly. The fed's most recent set of economic projections continued that rosy view of the world, with faster economic growth and a slightly lower unemployment rate than anticipated as of december, and. The fed is preparing to begin reversing the campaign of interest rate hikes it started in march 2022 to subdue a spike in inflation. between march 2022 and july 2023, the fed raised its benchmark.

Comments are closed.