The Consumer Financial Protection Bureau Requires Mortgage Lenders To

The Consumer Financial Protection Bureau Requires Mortgage Lenders To Rule requires lenders ensure borrowers have the ability to repay their mortgage. washington, d.c. – today the consumer financial protection bureau (cfpb) adopted a new rule that will protect consumers from irresponsible mortgage lending by requiring lenders to ensure prospective buyers have the ability to repay their mortgage. About us. we're the consumer financial protection bureau (cfpb), a u.s. government agency that makes sure banks, lenders, and other financial companies treat you fairly. learn how the cfpb can help you. call us if you still can’t find what you’re looking for. watch a video:.

/CFPB_2tone_Horiz_RGB-57bbffb95f9b58cdfde37029.png)

What Is The Consumer Financial Protection Bureau Bureau interpretive rule clears the way for heirs to take over mortgages when loved ones die. washington, d.c. – today, the consumer financial protection bureau (cfpb) is issuing an interpretive rule to clarify that when a borrower dies, the name of the borrower’s heir generally may be added to the mortgage without triggering the bureau’s ability to repay rule. Mortgage lenders are required to follow regulations set forth by the consumer financial protection bureau to safeguard consumers and the mortgage market. the cfpb mandates that lenders verify borrowers' financial information and assess their ability to repay, thereby preventing risky lending practices that could lead to financial instability. Requirements for higher priced mortgage loans, a revised and expanded test for high cost mortgages, as well as additional restrictions on those loans, expanded requirements for servicers of mortgage loans, refined loan originator compensation rules and loan origination qualification standards, and a prohibition on financing credit insurance for. Under hmda and regulation c, certain mortgage lenders are required to maintain records of specified mortgage lending information for reporting purposes. in 2021, 4,338 lenders reported 15 million.

The Consumer Financial Protection Bureau Requirements for higher priced mortgage loans, a revised and expanded test for high cost mortgages, as well as additional restrictions on those loans, expanded requirements for servicers of mortgage loans, refined loan originator compensation rules and loan origination qualification standards, and a prohibition on financing credit insurance for. Under hmda and regulation c, certain mortgage lenders are required to maintain records of specified mortgage lending information for reporting purposes. in 2021, 4,338 lenders reported 15 million. Español. a qualified mortgage is a category of loans that have certain, less risky features that help make it more likely that you’ll be able to afford your loan. a lender must make a good faith effort to determine that you have the ability to repay your mortgage before you take it out. this is known as the “ ability to repay ” rule. The consumer financial protection bureau (cfpb) helps consumers by providing educational materials and accepting complaints. it supervises banks, lenders, and large non bank entities, such as credit reporting agencies and debt collection companies. the bureau also works to make credit card, mortgage, and other loan disclosures clearer, so consumers can understand their rights and responsibilities.

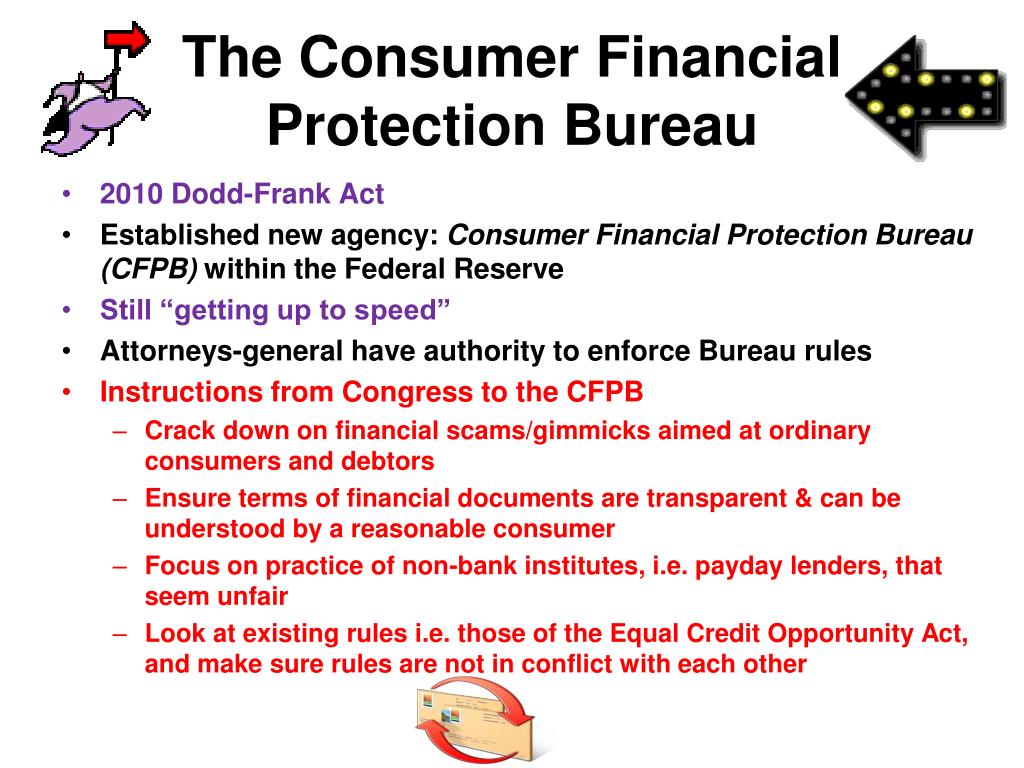

Ppt Consumer Protection Powerpoint Presentation Free Download Id Español. a qualified mortgage is a category of loans that have certain, less risky features that help make it more likely that you’ll be able to afford your loan. a lender must make a good faith effort to determine that you have the ability to repay your mortgage before you take it out. this is known as the “ ability to repay ” rule. The consumer financial protection bureau (cfpb) helps consumers by providing educational materials and accepting complaints. it supervises banks, lenders, and large non bank entities, such as credit reporting agencies and debt collection companies. the bureau also works to make credit card, mortgage, and other loan disclosures clearer, so consumers can understand their rights and responsibilities.

Ppt Consumer Protection Powerpoint Presentation Free Download Id

Comments are closed.