Tax Calculation Formula In Excel

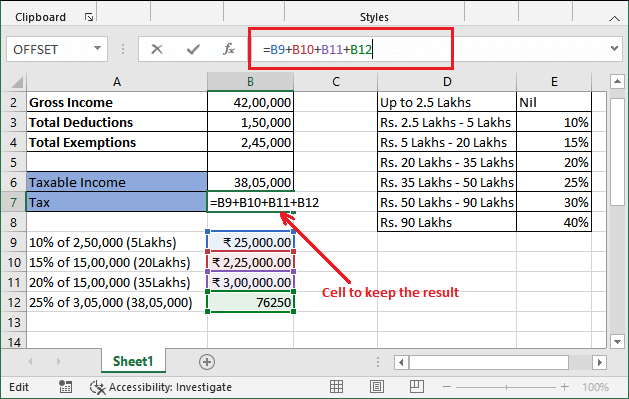

Income Tax Calculating Formula In Excel Javatpoint Step 5 – calculate federal tax rate. we will compute the effective tax rate by applying the following formula: effective federal tax rate = total tax expenses total taxable income. the total tax expense is $15,738.75 (cell g8), and the total taxable income is $80,000 (cell f8). download the practice workbook. calculating federal tax.xlsx. Step 1 – set up income tax slab. to illustrate how to calculate taxes, we’ll use the following tax rate sample: a flat 7% for incomes 0 to $10,000. $750 12% for income from $10,001 to $15,000. $1000 18% for income from $15,001 to $20,000. $1,350 27% for income from $20,001 to $30,000. $1,700 32% for income from $30,001 and higher.

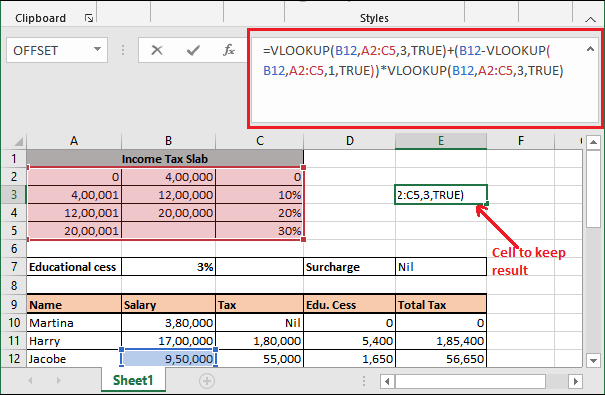

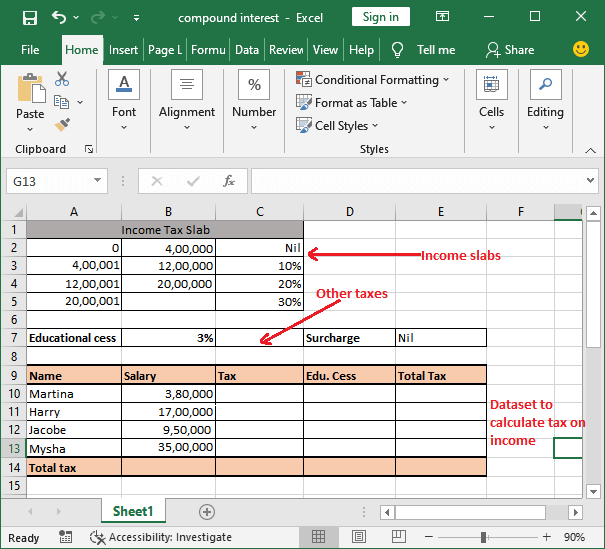

Income Tax Calculating Formula In Excel Javatpoint Summary. = index (tax table,0, match (c4, status list,0) * 2 1) to calculate the total income tax owed in a progressive tax system with multiple tax brackets, you can use a simple, elegant approach that leverages excel's new dynamic array engine. in the worksheet shown, the main challenge is to split the income in cell i4 into the correct tax. If the income is not at least $9,951, then i just multiply the total income by the tax rate. here is what the formula looks like using named ranges: =if (income>=incomelevel2,incomelevel2 incomelevel1,income)*taxrate1. for the second tax bracket calculation, i can follow similar logic. i will multiply the difference between the start of the. Learn how to use the vlookup function to calculate the tax on an income based on australian tax rates. see the formula, the example and the explanation with screenshots. Learn how to compute income tax in excel using tax tables, vlookup, sumproduct, indirect, and data validation. see examples, formulas, and screenshots for different approaches and scenarios.

Income Tax Calculating Formula In Excel Javatpoint Learn how to use the vlookup function to calculate the tax on an income based on australian tax rates. see the formula, the example and the explanation with screenshots. Learn how to compute income tax in excel using tax tables, vlookup, sumproduct, indirect, and data validation. see examples, formulas, and screenshots for different approaches and scenarios. Let’s take a look at some examples of how these basic tax formulas can be used in excel: income tax calculation: to calculate income tax in excel, you can use the if function to test different income levels and apply different tax rates. for example, if a person’s income is less than $50,000, the tax rate is 10%, and if their income is over. In this video you'll learn how to use vlookup and if formulas in microsoft excel to create your own federal income tax calculator. the process is simple and.

Tax Rate Calculation With Fixed Base Excel Formula Exceljet Let’s take a look at some examples of how these basic tax formulas can be used in excel: income tax calculation: to calculate income tax in excel, you can use the if function to test different income levels and apply different tax rates. for example, if a person’s income is less than $50,000, the tax rate is 10%, and if their income is over. In this video you'll learn how to use vlookup and if formulas in microsoft excel to create your own federal income tax calculator. the process is simple and.

Income Tax Calculating Formula In Excel Javatpoint

Comments are closed.