Payment Processing Industry Overview

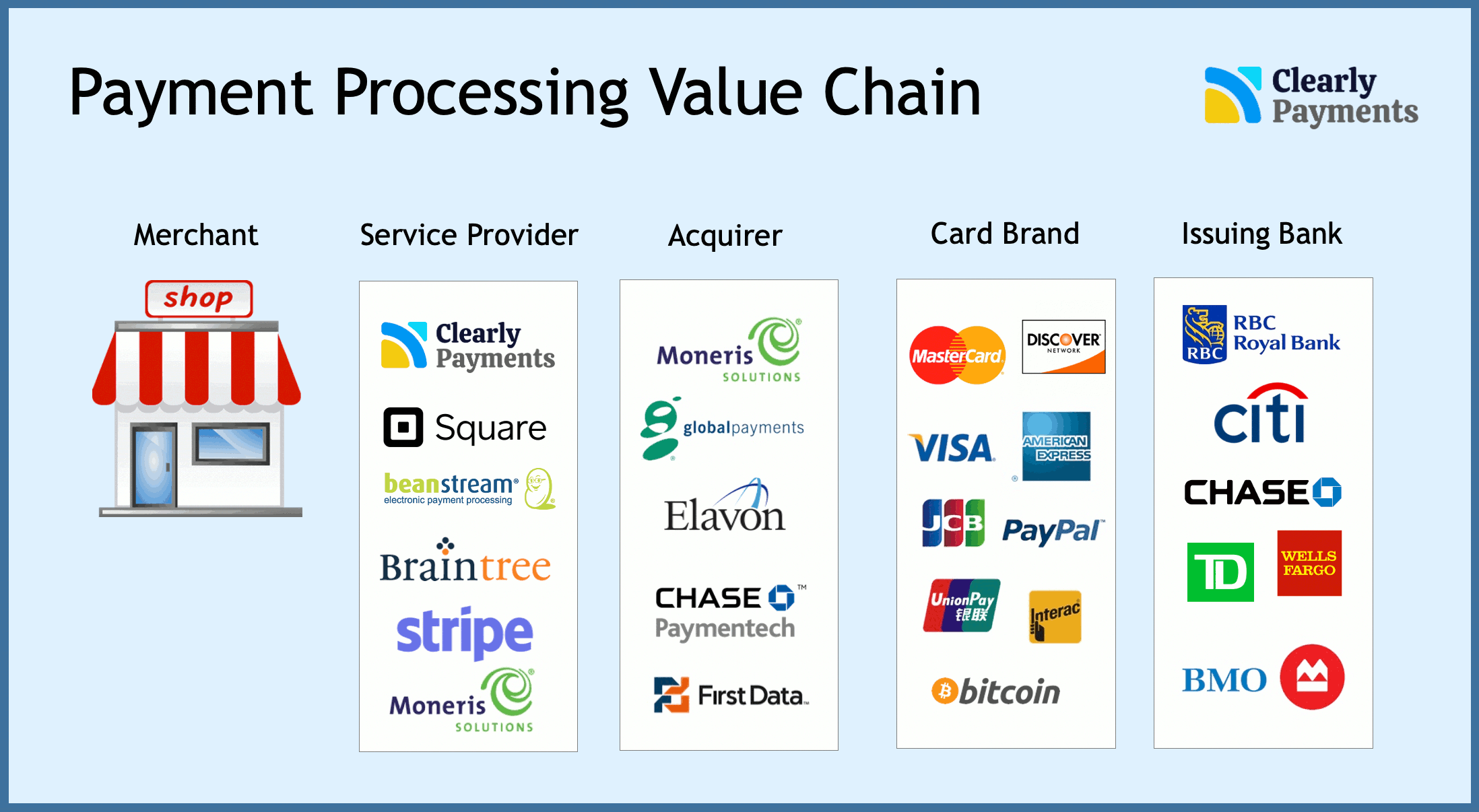

Credit Card And Payment Processing Industry Overview Credit Card A close look at revenues uncovers structural changes, including new developments in instant payments and digital wallets. this 2023 edition of mckinsey’s global payments report shares key findings from our proprietary market intelligence recorded in the global payments map, which spans more than 25 payments products in 47 countries that. In 2022, the global payment processing solutions market was valued at usd 47.61 billion, with expectations for a compound annual growth rate (cagr) of 14.5% through 2030. the payment industry is characterized by current trends, innovations, and a complex ecosystem that facilitates seamless transactions.

How Does The Payment Processing Industry Work Paykickstart Blog Payment processor market analysis. the global payment processor market size is estimated at usd 56.31 billion in 2024, and is expected to reach usd 93.62 billion by 2029, growing at a cagr of 10.70% during the forecast period (2024 2029). the market growth can be attributed to the rising global prevalence of the internet and smartphones. According to mckinsey’s latest report 3 on global trade and value chains, in 2017, total global trade stood at $22 trillion, with trade in goods at $17 trillion. trade in services, though smaller at $5 trillion, has outpaced growth in goods trade by more than 60 percent over the past decade (cagr of 3.9 percent). The payments industry was busy in 2021 and will continue to transform in 2022. learn about five high impact trends, such as payments modernization, cryptocurrency, and saas platforms, that will shape the market in the year ahead. The top 20 largest payments companies saw their tsr drop by an average of 20% over the past two years. acquiring and payments processing witnessed the sharpest declines, with tsr falling by roughly 40%. payments focused fintechs now number more than 5,000 globally and account for about $100 billion of total industry revenues.

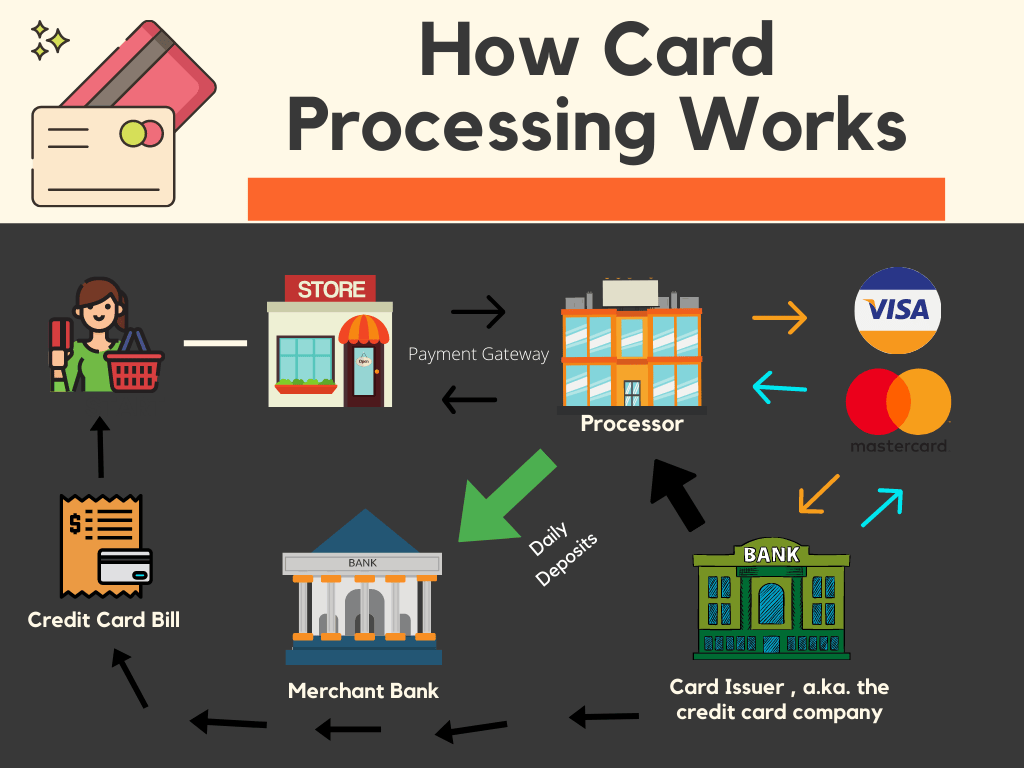

How The Payment Processing Industry Works Stocks To Consider The payments industry was busy in 2021 and will continue to transform in 2022. learn about five high impact trends, such as payments modernization, cryptocurrency, and saas platforms, that will shape the market in the year ahead. The top 20 largest payments companies saw their tsr drop by an average of 20% over the past two years. acquiring and payments processing witnessed the sharpest declines, with tsr falling by roughly 40%. payments focused fintechs now number more than 5,000 globally and account for about $100 billion of total industry revenues. To win customers, develop new solutions, and claim mar. et share. in short, the payments chessboard is being rearranged.the mckinsey 2022 global payments report presents a detailed analysis of the 2021 results and the in. ights they reveal, including regional and country level nuances. the report’s later chapters offer perspectives on areas. The payment processing industry overview digitization has been accelerated across peer to peer (p2p), business to consumer (b2c), and business to business (b2b) transactions beginning in 2020, but the second full year of the pandemic made it clear that they’re here to stay, even as spending levels normalize.

Comments are closed.