Payment Processing 101 5 Steps To Selecting A Provider

Payment Processing 101 5 Steps To Selecting A Provider Simple Marketing As a business owner you are in the business of making money. but how you go about actually collecting that money can have a big impact to your bottom line. c. Businesses are increasingly turning to online payment processing to meet growing customer demand. one recent study found that online payments are projected to reach $6.7 trillion globally by 2023. beyond accepting online payments, businesses should also provide exceptional customer experience, maximum flexibility, and strong security standards.

How Does Payment Processing Work Explained In Detail Conclusion: payment processing 101. choosing the right online payment processing provider is crucial for offering a secure and seamless payment experience. by evaluating these factors and selecting a provider that meets your specific needs, businesses can enhance their online payment processes and meet customer expectations. Understanding the payment processing system enables business owners to select a secure and efficient merchant service provider. look for a merchant service provider that emphasizes data security, optimizes for mobile payments, allows for multiple payment options, and offers helpful reporting tools. Common costs associated with credit card processing include: transaction fees: these are fees that the payment processing provider charges per transaction, usually expressed as a percentage of the transaction amount plus a fixed fee. for example, stripe charges 2.9% $0.30 per successful card charge. Payment processing. payment processing refers to the series of steps and technologies involved in authorizing, processing, and settling transactions between customers and merchants. it enables businesses to accept various payment methods securely and efficiently. the payment processing cycle typically involves the following steps:.

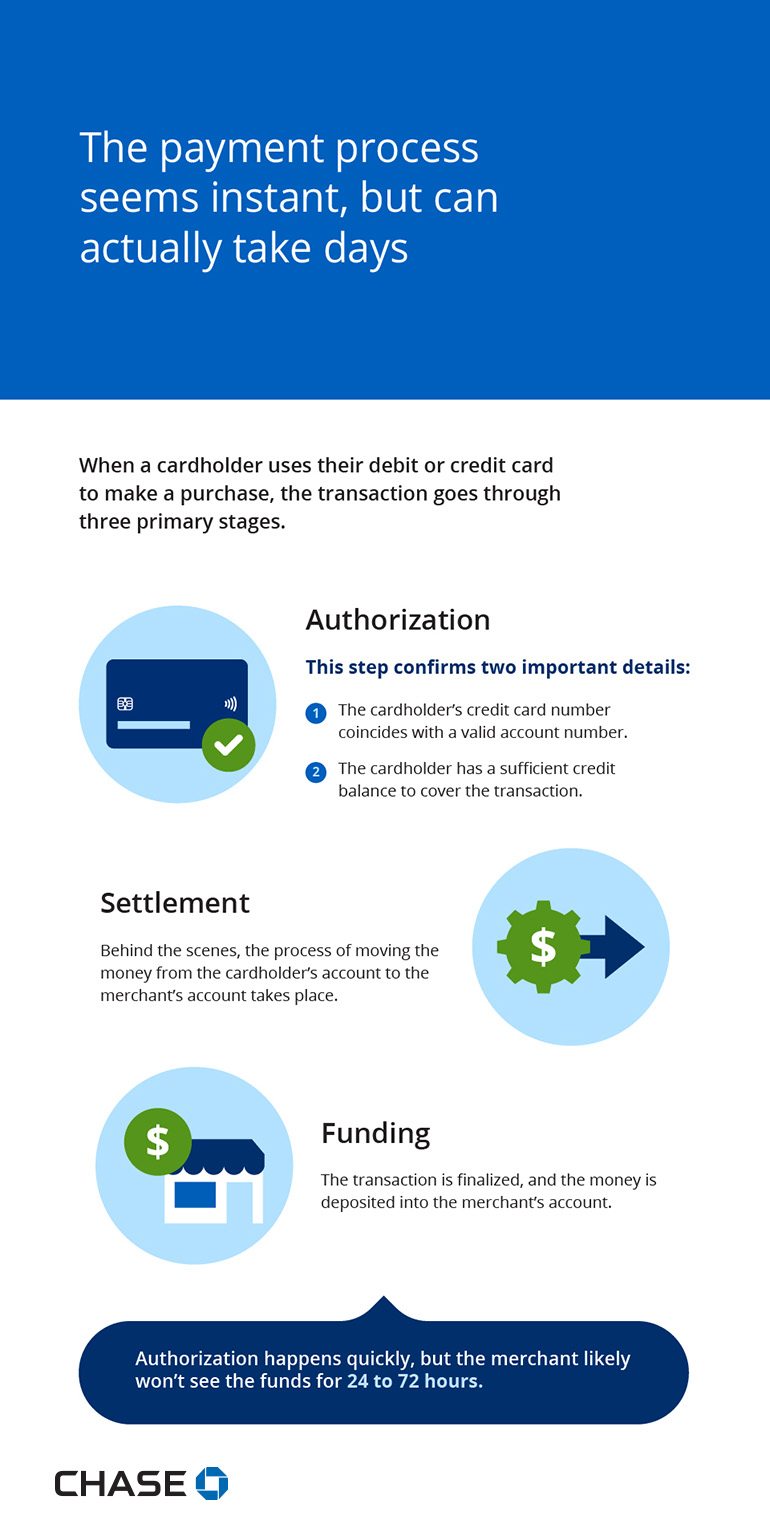

Checklist 5 Steps To Secure And Reliable Payment Processes Ctmfile Common costs associated with credit card processing include: transaction fees: these are fees that the payment processing provider charges per transaction, usually expressed as a percentage of the transaction amount plus a fixed fee. for example, stripe charges 2.9% $0.30 per successful card charge. Payment processing. payment processing refers to the series of steps and technologies involved in authorizing, processing, and settling transactions between customers and merchants. it enables businesses to accept various payment methods securely and efficiently. the payment processing cycle typically involves the following steps:. June 06, 2023. this payment processing guide provides a clear, concise, and complete look at how businesses accept and process payments. it offers valuable information on topics such as interchange fees, pci compliance, and mobile payments. read a summary of our credit card processing 101 summary below download the complete pdf here. As a business owner, it’s helpful to understand exactly what it looks like to process online payments. or, in other words, how money moves from your customer to your business. there are two stages to online payment processing: authorization (approving the sale) and settlement (getting the money in your account).

Payment Processing 101 The Basics Every Business Owner Needs To Know June 06, 2023. this payment processing guide provides a clear, concise, and complete look at how businesses accept and process payments. it offers valuable information on topics such as interchange fees, pci compliance, and mobile payments. read a summary of our credit card processing 101 summary below download the complete pdf here. As a business owner, it’s helpful to understand exactly what it looks like to process online payments. or, in other words, how money moves from your customer to your business. there are two stages to online payment processing: authorization (approving the sale) and settlement (getting the money in your account).

Payment Processing 101 Chase Payment Solutions Chase Ca

Comments are closed.