Panic Buying Begins Central Banks Are Printing Like Crazy

Central Banks Liquidity Swap Panic At The Printers 🚨 will central bank easing ignite one last surge in the bull market? 🚨in this must watch episode, bob & phil dive deep into the recent global surge in cent. Conclusion. this economic panic in 1837 was caused by the interconnected global economic system that was present in the 1830s. the open economy allowed for pennsylvania's financial crisis to be transmitted to other states. this caused monetary policies to be weakened and a panic spread throughout the midwest.

Crazy Money Printing By Central Banks Far From Over Hurrah For Gold In the run up to the panic, the banking system was busy financing the construction of railroads and canals, offering credit to those buying government lands and those expanding agricultural and manufacturing ventures. the government was making so much money from land sales and the tariff of 1833 that its debt was paid off in 1835. Bank panics in 1930 and 1931 were regional in nature, but the financial crisis spread throughout the entire nation starting in the fall of 1931. the crowd outside of the east new york savings bank during the run on that bank, november 24, 1933 (photo: bettmann bettmann getty images) by kristie m. engemann, federal reserve bank of st. louis. the. Panic of 1837. the panic of 1837 was a financial crisis in the united states that began a major depression (not to be confused with the great depression), which lasted until the mid 1840s. profits, prices, and wages dropped, westward expansion was stalled, unemployment rose, and pessimism abounded. the panic had both domestic and foreign origins. The banks were fractional reserve, and this feature is the one that made the bank panic possible” (1993: 428 n.1). howe (2007: 503) claims that “the pet banks were generally responsibly managed,” citing works that analyze the banking system as a whole, rather than the pet banks specifically. willenz (2005: 394, 445) characterizes the pet.

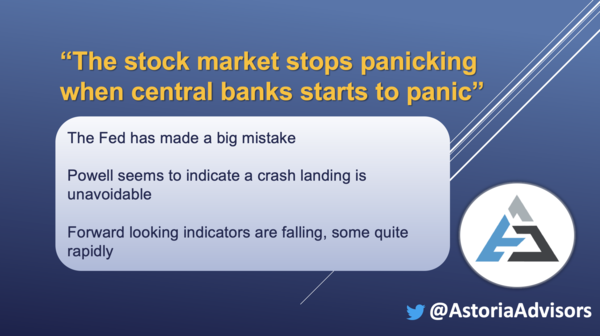

Stock Market Panic Stops When Central Bank Panic Starts Panic of 1837. the panic of 1837 was a financial crisis in the united states that began a major depression (not to be confused with the great depression), which lasted until the mid 1840s. profits, prices, and wages dropped, westward expansion was stalled, unemployment rose, and pessimism abounded. the panic had both domestic and foreign origins. The banks were fractional reserve, and this feature is the one that made the bank panic possible” (1993: 428 n.1). howe (2007: 503) claims that “the pet banks were generally responsibly managed,” citing works that analyze the banking system as a whole, rather than the pet banks specifically. willenz (2005: 394, 445) characterizes the pet. The panic of 1837 led to a general economic depression. between 1839 and 1843, the total capital held by american banks dropped by forty percent as prices fell and economic activity around the nation slowed to a crawl. the price of cotton in new orleans, for instance, dropped fifty percent. travelling through new orleans in january 1842, a. Panic buying is a type of behavior marked by a rapid increase in purchase volume, typically causing the price of a good or security to increase. panic buying in the financial markets is typically.

Central Banks Are Panic Buying Gold What Do They Know Nexus Newsfeed The panic of 1837 led to a general economic depression. between 1839 and 1843, the total capital held by american banks dropped by forty percent as prices fell and economic activity around the nation slowed to a crawl. the price of cotton in new orleans, for instance, dropped fifty percent. travelling through new orleans in january 1842, a. Panic buying is a type of behavior marked by a rapid increase in purchase volume, typically causing the price of a good or security to increase. panic buying in the financial markets is typically.

Comments are closed.