Introduction To Inflation

Introduction To Inflation Youtube Get to know and directly engage with senior mckinsey experts on inflation. ondrej burkacky is a senior partner in mckinsey’s munich office, axel karlsson is a senior partner in the stockholm office, fernando perez is a senior partner in the miami office, emily reasor is a senior partner in the denver office, and daniel swan is a senior partner in the stamford, connecticut, office. Inflation is a general and ongoing rise in the level of prices in an entire economy. inflation does not refer to a change in relative prices. a relative price change occurs when you see that the price of tuition has risen, but the price of laptops has fallen. inflation, on the other hand, means that there is pressure for prices to rise in most.

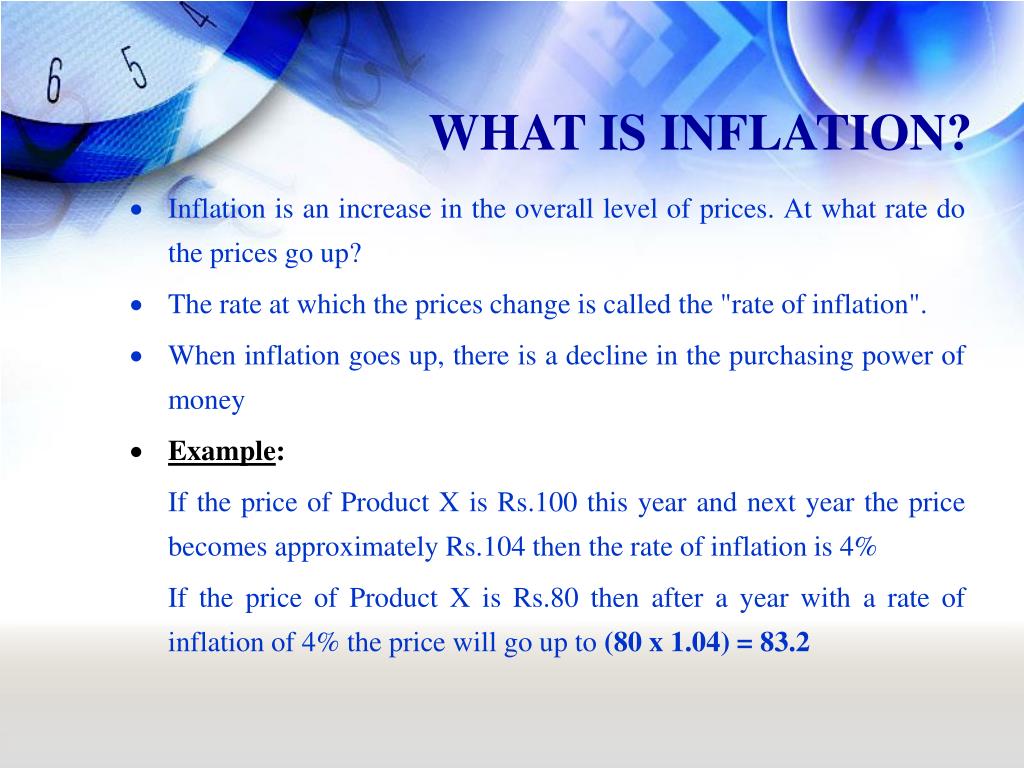

Ppt Inflation Powerpoint Presentation Free Download Id 4361214 Percent inflation rate = (308.417 ÷ 52.1) x 100 = (5.9197) x 100 = 591.97%. since you wish to know how much $10,000 from january 1975 would be worth in january 2024, multiply the inflation rate. To measure inflation, we look at the consumer price index (cpi) and how quickly it is rising. for example: in one year, the basket of goods and services the cpi uses costs $100. the next year, the same basket costs $102. that means the average annual rate of inflation is 2 percent. at the bank, we target a 2 percent inflation rate, the middle. Encyclopædia britannica, inc. 1. the quantity theory of money. thesis: inflation is determined by the money supply. as the first and oldest of the inflation theories, the quantity theory of moneyviews inflation as primarily a “monetary” occurrence. in other words, the influence of the amount of money in the economy takes precedence over. The chapter concludes with a discussion of some imperfections and biases in the inflation statistics, and a preview of policies for fighting inflation that we will discuss in other chapters. this page titled 9.1: introduction to inflation is shared under a cc by 4.0 license and was authored, remixed, and or curated by openstax via source content that was edited to the style and standards of.

Inflation Encyclopædia britannica, inc. 1. the quantity theory of money. thesis: inflation is determined by the money supply. as the first and oldest of the inflation theories, the quantity theory of moneyviews inflation as primarily a “monetary” occurrence. in other words, the influence of the amount of money in the economy takes precedence over. The chapter concludes with a discussion of some imperfections and biases in the inflation statistics, and a preview of policies for fighting inflation that we will discuss in other chapters. this page titled 9.1: introduction to inflation is shared under a cc by 4.0 license and was authored, remixed, and or curated by openstax via source content that was edited to the style and standards of. The bank of canada aims to keep inflation at the 2 per cent midpoint of an inflation control target range of 1 to 3 per cent. the inflation target is expressed as the year over year increase in the total consumer price index (cpi). the cpi is the most relevant measure of the cost of living for most canadians because it is made up of goods and. Inflation is when most prices in an entire economy are rising. however, there is an extreme form of inflation called hyperinflation. this occurred in germany between 1921 and 1928, and more recently in zimbabwe between 2008 and 2009. in november 2008, zimbabwe had an inflation rate of 79.6 billion percent.

Topic 17 Inflation Introduction To Inflation Economaldives Error The bank of canada aims to keep inflation at the 2 per cent midpoint of an inflation control target range of 1 to 3 per cent. the inflation target is expressed as the year over year increase in the total consumer price index (cpi). the cpi is the most relevant measure of the cost of living for most canadians because it is made up of goods and. Inflation is when most prices in an entire economy are rising. however, there is an extreme form of inflation called hyperinflation. this occurred in germany between 1921 and 1928, and more recently in zimbabwe between 2008 and 2009. in november 2008, zimbabwe had an inflation rate of 79.6 billion percent.

Comments are closed.