Introducing Equifax Credit Attributes

Introducing Equifax Credit Attributes Consumer attributes is a powerful portfolio of more than 7,000 cloud native credit attributes helps improve predictability and performance by tapping into alternative data attributes — so you can uncover unbanked, underbanked, and emerging consumers not found with traditional consumer credit files. Attribute library our most powerful and extensive library of consumer attributes leveraging data available through the equifax traditional consumer credit file. our attribute library can be used to identify a set of attributes that is the best fit for a specific goal and deployed through one of our configurable attribute packages. a a.

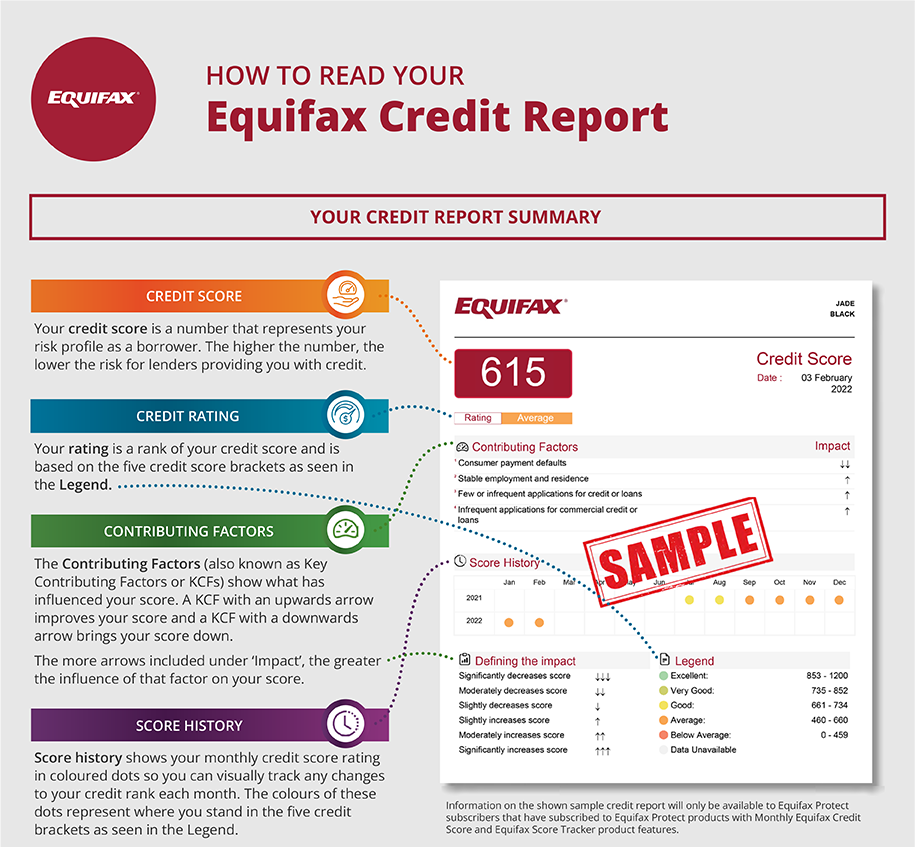

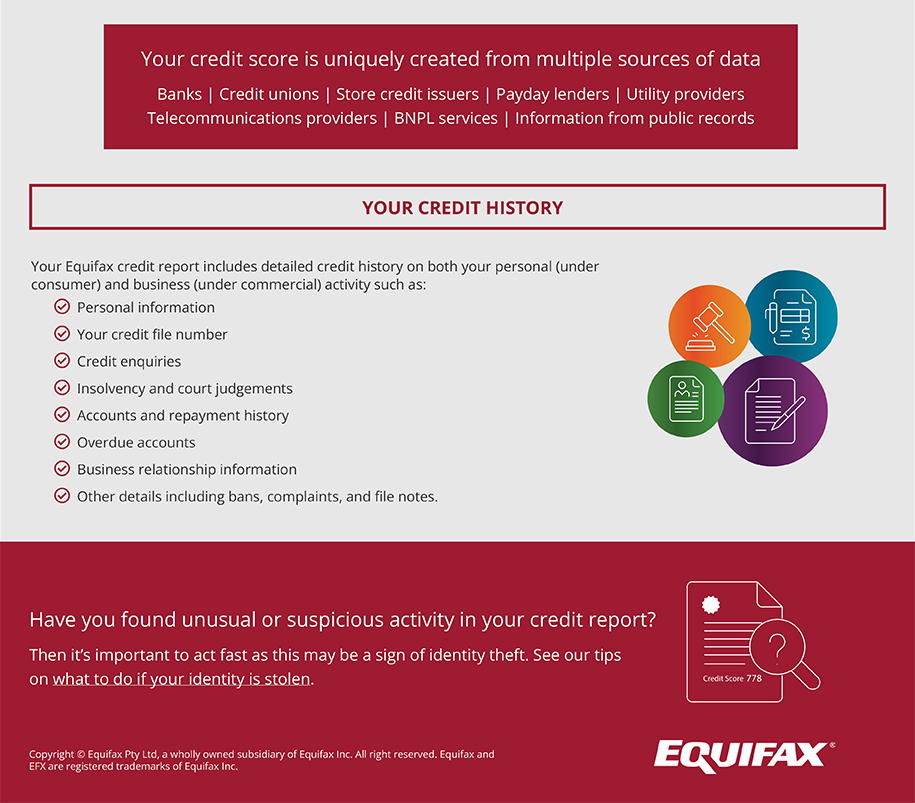

How To Read Your Equifax Credit Report Equifax Personal Equifax, a trusted leader in the industry, offers an extensive array of 2800 consumer attributes available through crs, each designed to provide unique insights into a borrower’s financial profile. these attributes encompass a wide range of data points, from the age of the oldest trade to the maximum credit limit on open trades. Onescore from equifax is a next generation risk score pairing industry leading, traditional consumer credit attributes with differentiated alternative data sources — helping you score more consumers and enhance your decisioning power. How to read a 24 month history. read the grid from left to right. the first field represents the previous month’s activity based on the date reported. for the example above, the “4” in the first field of the grid means the account was rated r4 in november 2005. There are over 2,700 multi bureau capable attributes, which cover the vast majority of attributes that companies use to fuel their models. with multi bureau attributes, companies can achieve better consistency and performance for their models. attribute values remain consistent regardless of the underlying data source.

How To Read Your Equifax Credit Report Equifax Personal How to read a 24 month history. read the grid from left to right. the first field represents the previous month’s activity based on the date reported. for the example above, the “4” in the first field of the grid means the account was rated r4 in november 2005. There are over 2,700 multi bureau capable attributes, which cover the vast majority of attributes that companies use to fuel their models. with multi bureau attributes, companies can achieve better consistency and performance for their models. attribute values remain consistent regardless of the underlying data source. Leveraging scores and attributes from equifax can help clients build a stronger foundation for predictive decisioning with current consumer credit risk perspective and for marketing optimization. access actionable consumer insights like onescore built from robust consumer credit and alternative data attributes and industry specific decisioning. Introduction. step 1: accessing the equifax website. step 2: logging into your equifax account. step 3: finding the “my credit report” section. step 4: selecting the desired credit report. step 5: generating a printable version. step 6: previewing and customizing the report. step 7: printing the equifax credit report.

Comments are closed.