Innovative Financing Issuances

Innovative Financing Issuances Youtube Z innovative finance includes mechanisms and solu tions, which increase the volume, efficiency, and effectiveness of financial flows. bond issuance, capital platforms; or by supporting. The world is facing interconnected challenges that require substantial support from multilateral development banks (mdbs) to address them. the world bank has been instrumental in the growth of the green, social, and sustainability bonds (gss) market since its first green bond issuance in 2008. other world bank financial innovations help expand financing and channel funds to development efforts.

Maximizing Business Growth With Innovative Financing Solutions Tweak The world bank group is the largest source of funding for developing countries, but more financing is needed to address the most pressing development challenges of our time. that’s why the world bank is transforming its financial model through innovative, new financial instruments and by stretching its own capital, increasing ibrd’s financing capacity by at least $50 billion over the next. Innovative financing instruments for sustainable development, as called for in the addis ababa action agenda, are important contributions to bridge the sdg financing gap. as of early 2021, the sdg financing gap in developing countries is estimated to haveincreased by at least 50%, totalling usd 3.7 trillion in 2020. Another challenge that innovative finance has addressed is making vaccines available to the 71 poorest countries in the world. the international finance facility for immunisation (iffim) was launched in 2006 for this purpose. it front loads financing for vaccines by issuing vaccine bonds backed by the legally binding pledges from donors. A year of innovative issuances. green, social and sustainability bonds underwritten since 2014. $35b from clean energy to resilient infrastructure to corporate green initiatives, innovative financing is instrumental in the drive for sustainability. advancing environmental progress. building a thriving us green bond market.

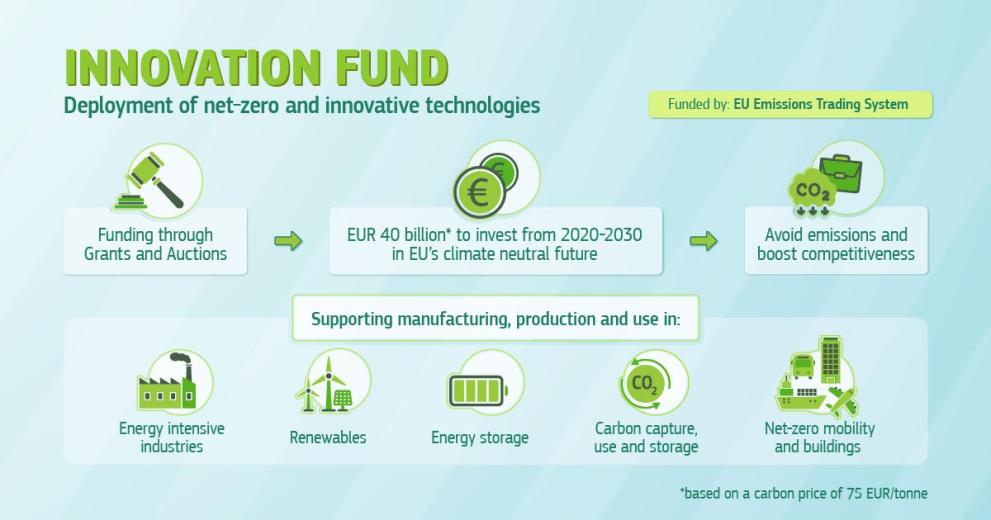

What Is The Innovation Fund European Commission Another challenge that innovative finance has addressed is making vaccines available to the 71 poorest countries in the world. the international finance facility for immunisation (iffim) was launched in 2006 for this purpose. it front loads financing for vaccines by issuing vaccine bonds backed by the legally binding pledges from donors. A year of innovative issuances. green, social and sustainability bonds underwritten since 2014. $35b from clean energy to resilient infrastructure to corporate green initiatives, innovative financing is instrumental in the drive for sustainability. advancing environmental progress. building a thriving us green bond market. S&p global ratings expects global issuance of sustainable bonds including green, social, sustainability, and sustainability linked bonds will surpass $1.5 trillion in 2022. we believe sustainability linked bonds will be the fastest growing segment of the market. green bonds will also see record issuance volumes in 2022, maintaining their position as the dominant sustainable bond category. Closing the gap between available financing for climate change adaptation and the needs of developing countries requires looking beyond traditional sources of finance—i.e., grants and (concessional) loans—to innovative financial instruments and mechanisms that can unlock (private) investment. these instruments are increasingly viewed as a means to scale up the investment needed for.

The Next Frontier Of Innovative Finance Impact Linked Finance Ande S&p global ratings expects global issuance of sustainable bonds including green, social, sustainability, and sustainability linked bonds will surpass $1.5 trillion in 2022. we believe sustainability linked bonds will be the fastest growing segment of the market. green bonds will also see record issuance volumes in 2022, maintaining their position as the dominant sustainable bond category. Closing the gap between available financing for climate change adaptation and the needs of developing countries requires looking beyond traditional sources of finance—i.e., grants and (concessional) loans—to innovative financial instruments and mechanisms that can unlock (private) investment. these instruments are increasingly viewed as a means to scale up the investment needed for.

Comments are closed.