Inflation Definition Types Causes Effects Of Inflation And Measures To Control Inflation

Inflation Definition And What Causes Inflation Methods Used To Inflation is when a country's economy sees an increase in the prices of products and services due to a decline in purchasing power. david hume first proposed the concept in the 18th century. inflation types include demand pull, cost pull, creeping, galloping, and hyperinflation. in this situation, borrowers, businessmen, entrepreneurs, farmers. Inflation refers to the sustained increase in the general price level of goods and services in an economy over a period of time. it is a key economic indicator that affects the purchasing power of money and can have significant implications for businesses, consumers, and governments. understanding inflation is crucial for making informed.

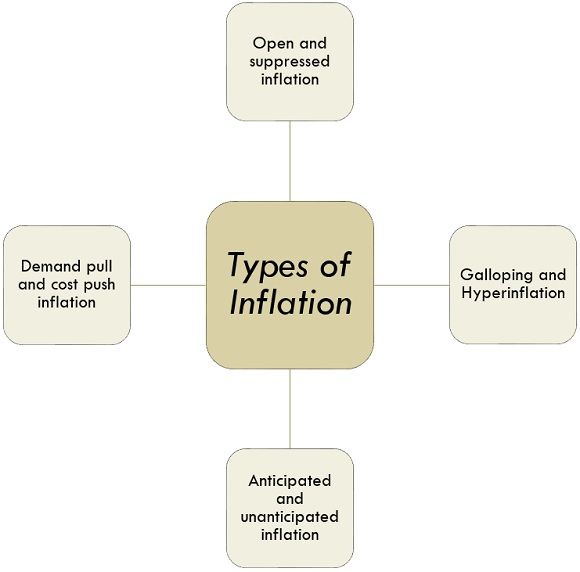

Types Of Inflation In Economics Definition Causes Effects What causes inflation? monetary policy is a critical driver of inflation over the long term. the current high rate of inflation is a result of increased money supply, high raw materials costs, labor mismatches, and supply disruptions—exacerbated by geopolitical conflict. in general, there are two primary types, or causes, of short term inflation:. Percent inflation rate = (308.417 ÷ 52.1) × 100 = (5.9197) × 100 = 591.97%. since you wish to know how much $10,000 from january 1975 would be worth in january 2024, multiply the inflation rate. The main causes of inflation are classified as demand pull inflation, cost push inflation, and built in inflation. demand pull inflation is when the demand for goods and services exceeds. Inflation is the rise in the prices of goods and services. when goods and services become more expensive, it translates into less purchasing power for consumers. inflation is typically measured by.

What Is Inflation Types Effects Causes And Measures To Control T The main causes of inflation are classified as demand pull inflation, cost push inflation, and built in inflation. demand pull inflation is when the demand for goods and services exceeds. Inflation is the rise in the prices of goods and services. when goods and services become more expensive, it translates into less purchasing power for consumers. inflation is typically measured by. What are the main causes of inflation? there are two primary types, or causes, of inflation: — demand pull inflation occurs when the demand for goods and services in the economy exceeds the economy’s ability to produce them. for example, when demand for new cars recovered more quickly than anticipated from its sharp dip. To measure inflation, we look at the consumer price index (cpi) and how quickly it is rising. for example: in one year, the basket of goods and services the cpi uses costs $100. the next year, the same basket costs $102. that means the average annual rate of inflation is 2 percent. at the bank, we target a 2 percent inflation rate, the middle.

рџњ 3 Main Causes Of Inflation Inflation Types Causes And Effectsођ What are the main causes of inflation? there are two primary types, or causes, of inflation: — demand pull inflation occurs when the demand for goods and services in the economy exceeds the economy’s ability to produce them. for example, when demand for new cars recovered more quickly than anticipated from its sharp dip. To measure inflation, we look at the consumer price index (cpi) and how quickly it is rising. for example: in one year, the basket of goods and services the cpi uses costs $100. the next year, the same basket costs $102. that means the average annual rate of inflation is 2 percent. at the bank, we target a 2 percent inflation rate, the middle.

Comments are closed.