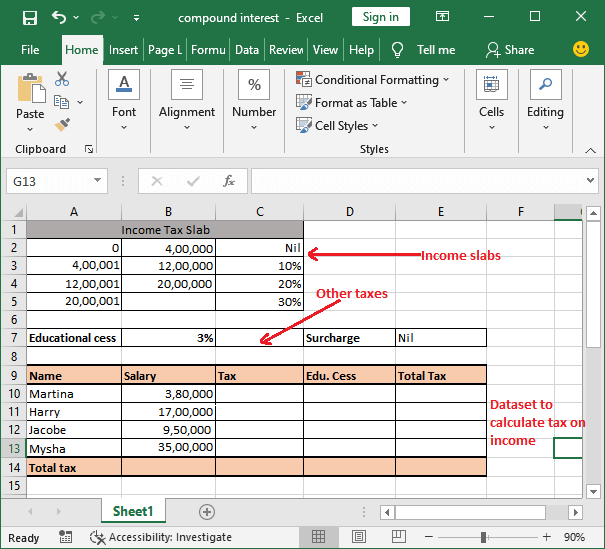

Income Tax Calculation Excel Sheet

Income Tax Calculation Sheet With Excel Calculator Po Tools Step 5 – calculate federal tax rate. we will compute the effective tax rate by applying the following formula: effective federal tax rate = total tax expenses total taxable income. the total tax expense is $15,738.75 (cell g8), and the total taxable income is $80,000 (cell f8). download the practice workbook. calculating federal tax.xlsx. Download a free excel based utility to estimate your tax liability based on your income and tax regime. compare the higher and lower tax rates, deductions and exemptions for fy 2023 24.

Income Tax Calculation Excel Sheet Free Download Gaibeach 3. simple blue tax estimator from wps. not everyone needs a more advanced excel tax template. the simple blue tax estimator is perfect if you just want to quickly calculate taxes owed or a refund. the template is a good way to estimate federal taxes for both individuals and self employed. it looks like a basic tax form. Summary. = index (tax table,0, match (c4, status list,0) * 2 1) to calculate the total income tax owed in a progressive tax system with multiple tax brackets, you can use a simple, elegant approach that leverages excel's new dynamic array engine. in the worksheet shown, the main challenge is to split the income in cell i4 into the correct tax. Prepare your federal income tax return with the help of these free to download and ready to use ready to use federal income tax excel templates. these templates include simple tax estimator, itemized deduction calculator, schedule b calculator, section 179 deduction calculator and much more. all excel templates are free to download and use. If the income is not at least $9,951, then i just multiply the total income by the tax rate. here is what the formula looks like using named ranges: =if (income>=incomelevel2,incomelevel2 incomelevel1,income)*taxrate1. for the second tax bracket calculation, i can follow similar logic. i will multiply the difference between the start of the.

Comments are closed.