How Do Credit Cards Work

How Do Credit Cards Work The Beginners Guide Chime A credit card is tied to a revolving line of credit that a bank has issued you. a debit card is tied to your bank account. this is an important distinction. with a credit card transaction, the. Learn the basics of credit cards, how they work, and how they differ from debit cards. find out how to use credit cards to build credit, earn rewards, and avoid fees and interest charges.

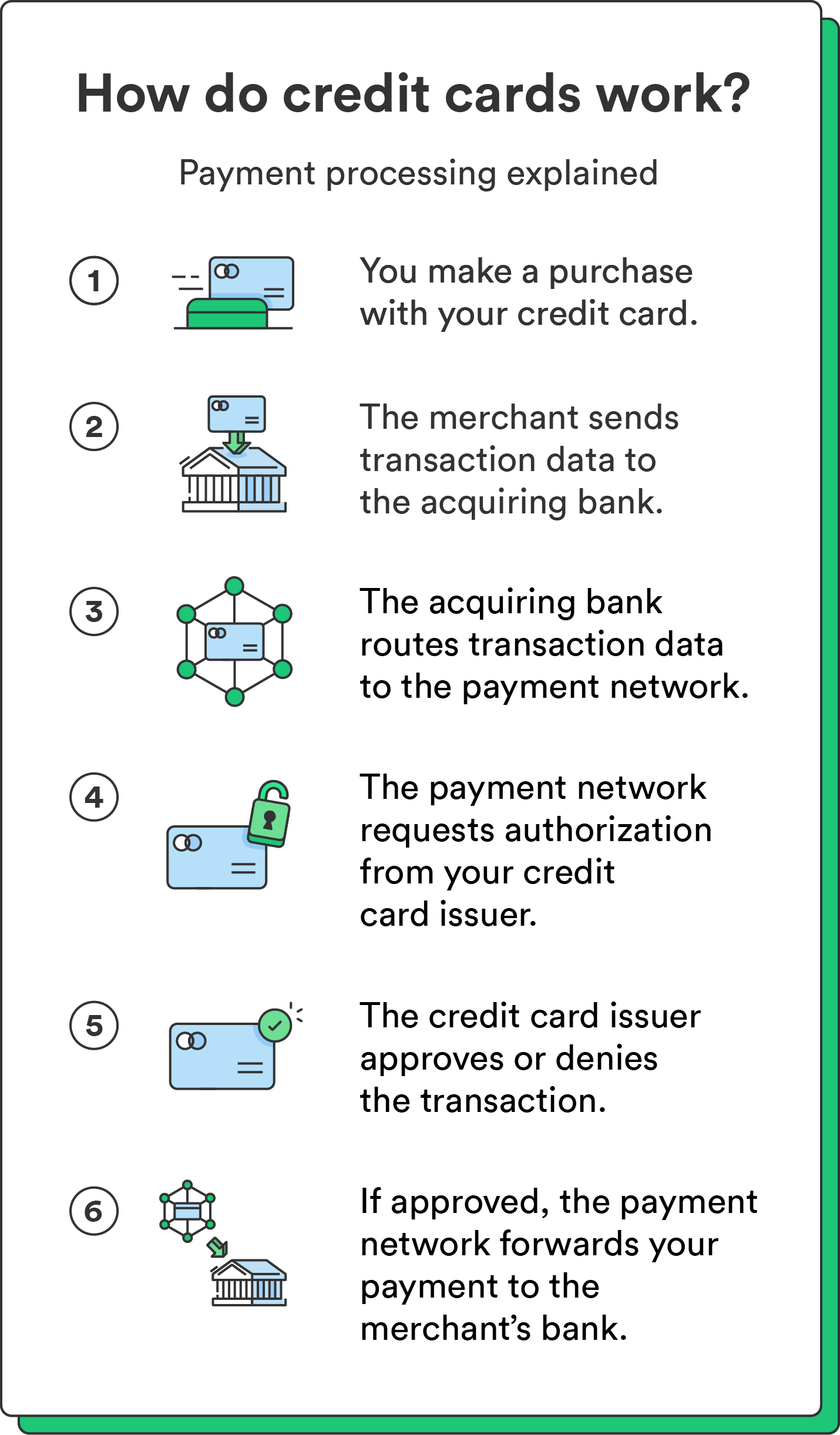

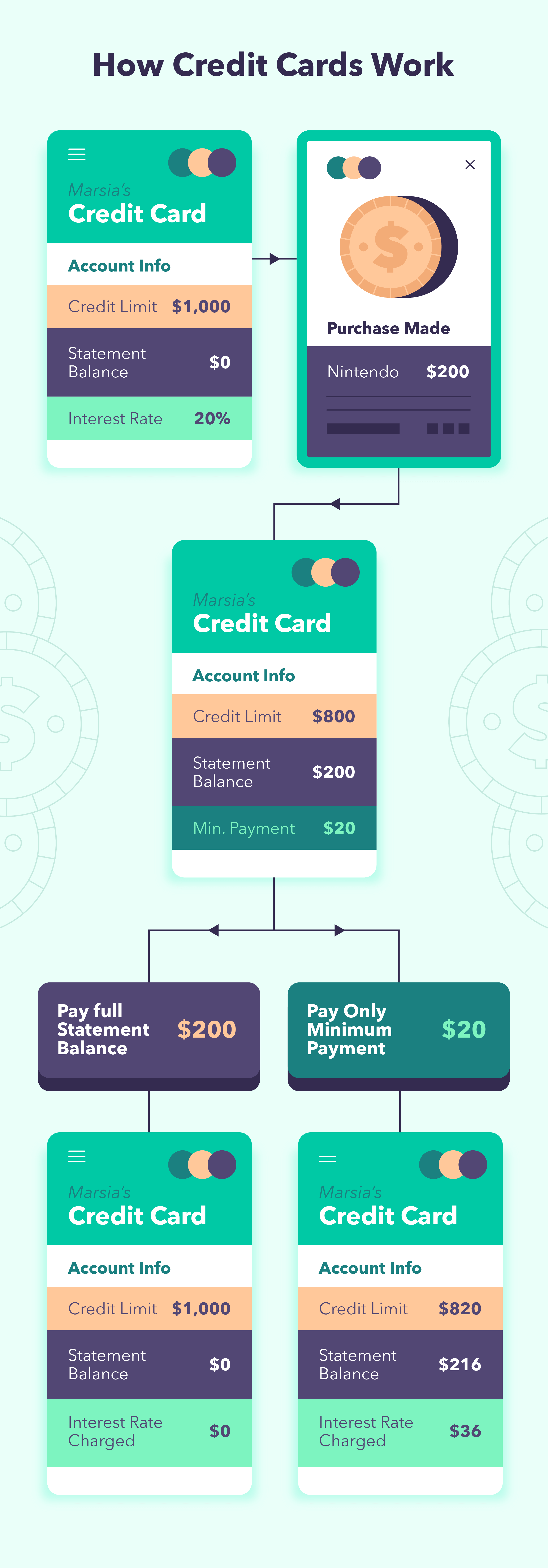

How Credit Cards Work Money World Basics Wallethub senior researcher. credit cards work on a buy now pay later basis. when you use a credit card to make a purchase, you’re borrowing money from the credit card’s issuer to complete the transaction, and then repaying the amount at the end of the billing cycle, either in part or in full. if you pay a credit card’s bill in full each. Learn about your options, the benefits of carrying a credit card and the potential risks of not using a card responsibly. armed with the understanding you'll get from credit cards 101, you'll be. Learn how credit cards work, from their basic functionality to smart usage tips. find out the types, benefits, risks, and best practices of credit cards, and how they can impact your credit score. Learn the basics of credit cards, how they let you borrow money and affect your credit score. compare different types of credit cards and how to apply for one.

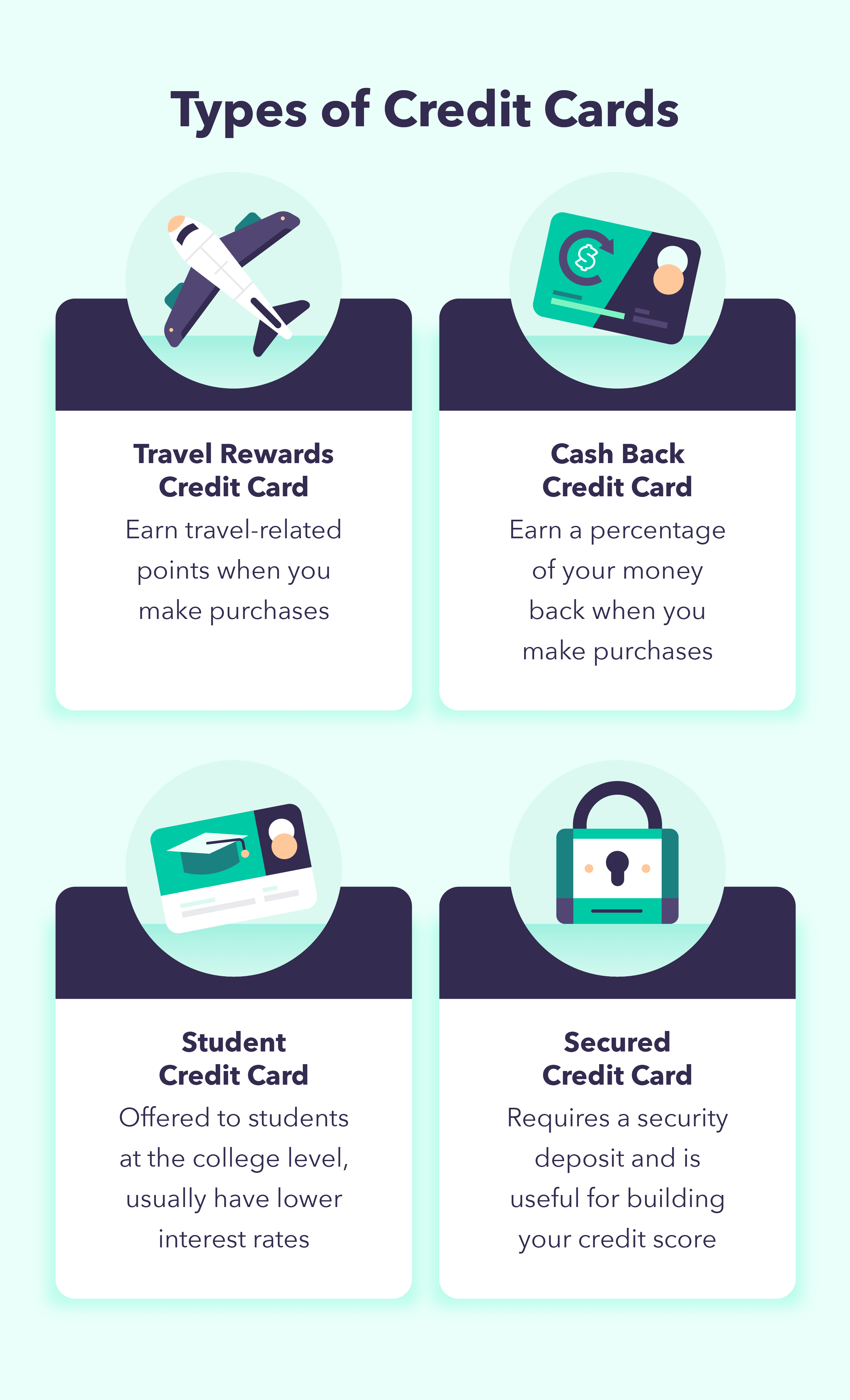

Credit Card 101 How Do Credit Cards Work Mintlife Blog Learn how credit cards work, from their basic functionality to smart usage tips. find out the types, benefits, risks, and best practices of credit cards, and how they can impact your credit score. Learn the basics of credit cards, how they let you borrow money and affect your credit score. compare different types of credit cards and how to apply for one. Learn the basics of credit cards, such as billing cycles, interest, fees, grace periods and revolving credit. find out how to choose your first card and pay it off responsibly. Usually, the cards with higher annual fees offer more generous rewards programs and provide more robust benefits and protections. balance transfer fee — most balance transfer cards charge a balance transfer fee of 3% or 5% of the amount of each transfer (with a $5 or $10 minimum). while there are a few cards available with no balance transfer.

Credit Card 101 How Do Credit Cards Work Mintlife Blog Learn the basics of credit cards, such as billing cycles, interest, fees, grace periods and revolving credit. find out how to choose your first card and pay it off responsibly. Usually, the cards with higher annual fees offer more generous rewards programs and provide more robust benefits and protections. balance transfer fee — most balance transfer cards charge a balance transfer fee of 3% or 5% of the amount of each transfer (with a $5 or $10 minimum). while there are a few cards available with no balance transfer.

How Do Credit Cards Work Gifographic For Kids Mocomi

Comments are closed.