Help Lexisnexis Risk Solutions Consumer Disclosure

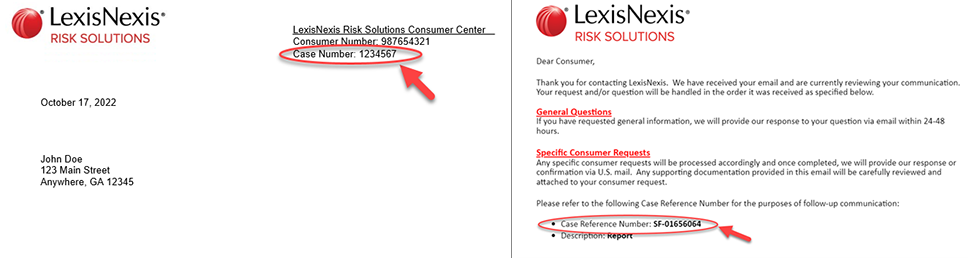

Home Lexisnexis Risk Solutions Consumer Disclosure If your insurance company has sent you an adverse action letter, please contact the lexisnexis consumer center at 1 800 456 6004 to request the information related to the adverse action. please be ready to provide your first and last name, social security number, driver’s license number and state in which it was issued, date of birth, current. Lexisnexis risk solutions consumer center. p.o. box 105108. atlanta, ga 30348 5108. printable request form. printable request form instructions. 3. request your consumer disclosure report by phone. consumers may request a consumer disclosure report via phone at 1 866 897 8126.

Help Lexisnexis Risk Solutions Consumer Disclosure Request and receive your consumer disclosure report online. select the request your consumer disclosure report checkbox below to submit an online request to access your file and learn more about the personal information lexisnexis risk solutions maintains about you in accordance with the fair credit reporting act. Contact us by mail at: lexisnexis risk solutions consumer center. p.o. box 105108. atlanta, ga, 30348 5108. contact us by phone at: 1 866 897 8126. The bottom of this document or call us at 1 888 217 1591 to speak to a live lexisnexis risk solutions consumer center representative. requesting a consumer disclosure report on behalf of a consumer minor, incapacitated, or deceased consumer a third party may request a consumer disclosure on behalf of a consumer who is a minor, incapacitated, or. You can request your security freeze via u.s. mail using the address below: lexisnexis risk solutions consumer center. attn: security freeze. p.o. box 105108. atlanta, ga 30348 5108. 3. request your security freeze by phone. you can request your security freeze via phone at 1 800 456 1244.

Visit Personalreports Lexisnexis Home Lexisnexis Risk Solutions The bottom of this document or call us at 1 888 217 1591 to speak to a live lexisnexis risk solutions consumer center representative. requesting a consumer disclosure report on behalf of a consumer minor, incapacitated, or deceased consumer a third party may request a consumer disclosure on behalf of a consumer who is a minor, incapacitated, or. You can request your security freeze via u.s. mail using the address below: lexisnexis risk solutions consumer center. attn: security freeze. p.o. box 105108. atlanta, ga 30348 5108. 3. request your security freeze by phone. you can request your security freeze via phone at 1 800 456 1244. As a consumer, and depending on the state of your residency, you may be able to request that a security freeze be placed on certain data that lexisnexis® risk solutions maintains about you, including some or all of the following: c.l.u.e. reports, current carrier reports, and riskview reports. Lexisnexis risk solutions is committed to the responsible use of data. we have been working with the insurance industry and regulators for years to analyze risk at the individual, household and book of business levels to help insurers offer individualized, appropriate premiums for the risk being covered. our solutions also help prevent fraud.

Lexisnexis Risk Solutions Customer Acquisition Solutions As a consumer, and depending on the state of your residency, you may be able to request that a security freeze be placed on certain data that lexisnexis® risk solutions maintains about you, including some or all of the following: c.l.u.e. reports, current carrier reports, and riskview reports. Lexisnexis risk solutions is committed to the responsible use of data. we have been working with the insurance industry and regulators for years to analyze risk at the individual, household and book of business levels to help insurers offer individualized, appropriate premiums for the risk being covered. our solutions also help prevent fraud.

Comments are closed.