Enterprise Risk Management Framework Diagram

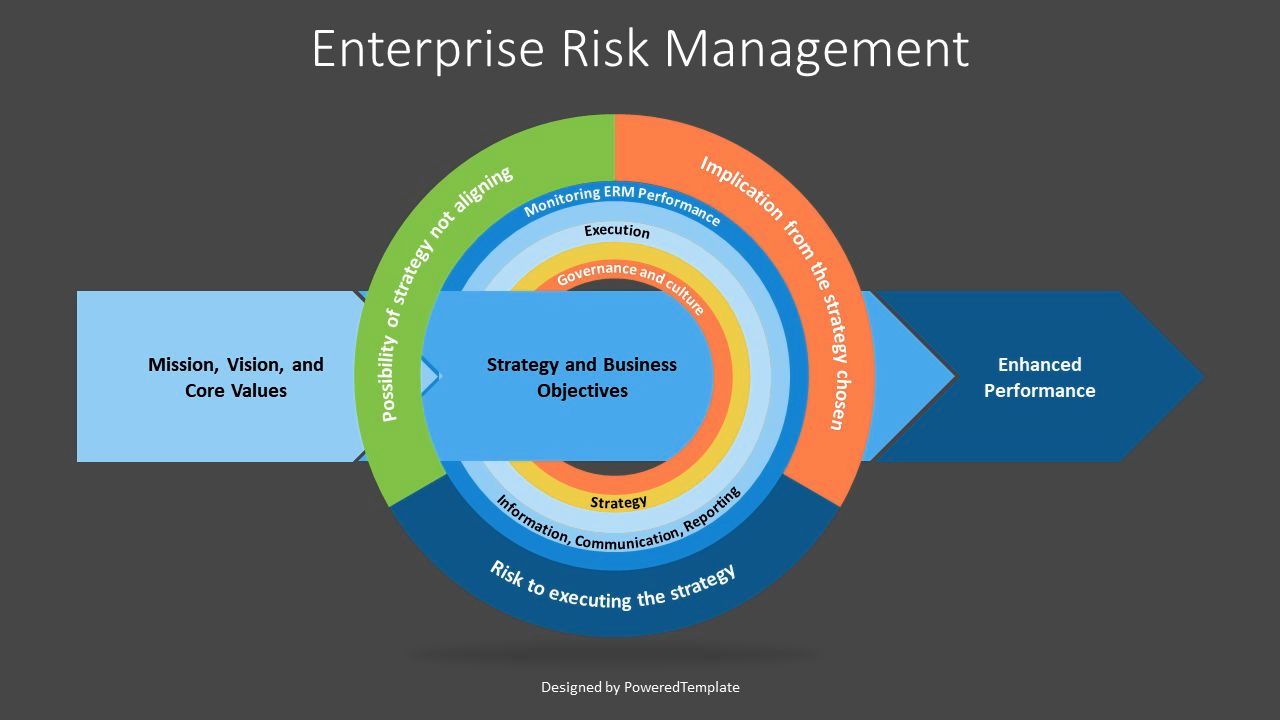

Enterprise Risk Management Framework Diagram Enterprise risk management frameworks relay crucial risk management principles. you can use an erm framework as a communication tool for identifying, analyzing, responding to, and controlling internal and external risks. an erm framework provides structured feedback and guidance to business units, executive management, and board members. Sophisticated since the term “enterprise risk management” (erm) was first used in the late 1990s. while the common definition of erm still holds—an enterprisewide strategy for identifying and preparing for the most impactful risks an organization faces—the scope of what’s possible through erm has well exceeded its original.

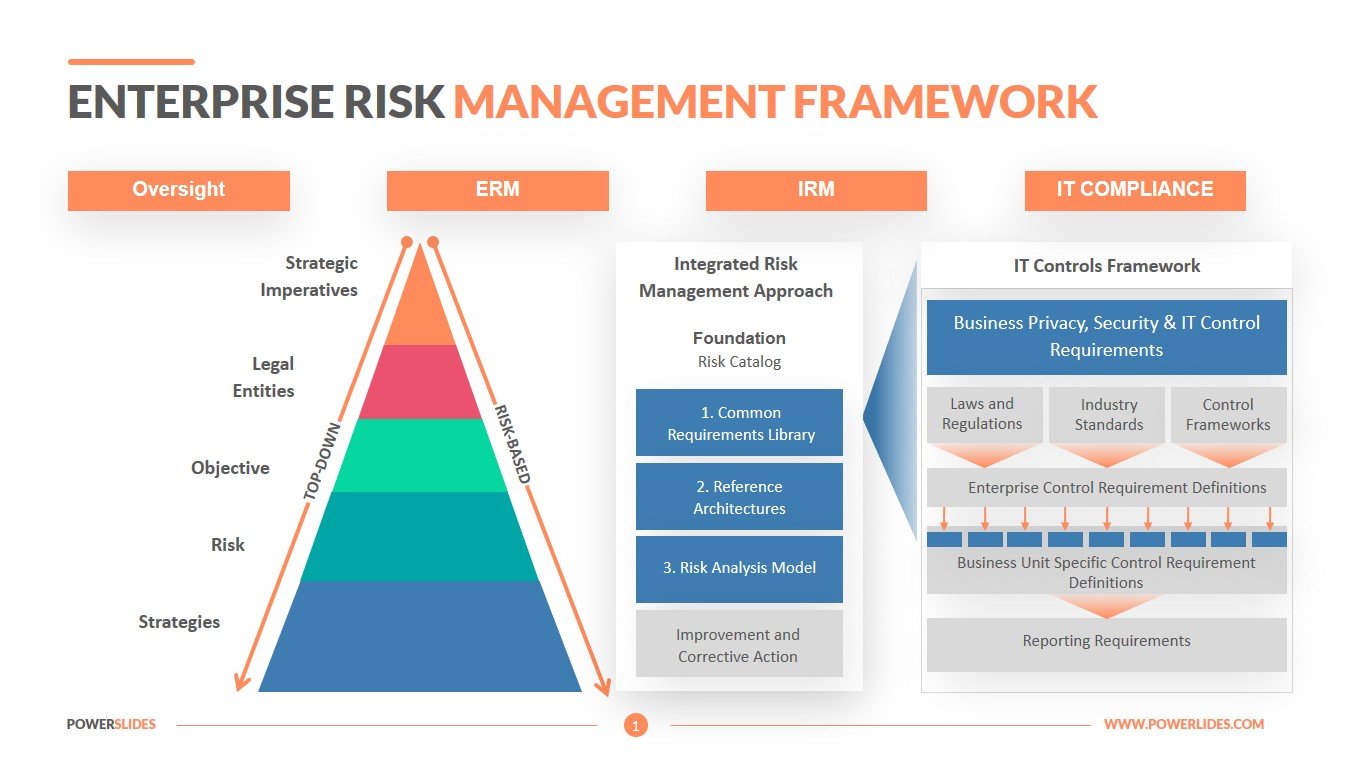

Enterprise Risk Governance And Risk University Of Queensland An enterprise risk management framework is a flexible solution that goes beyond reacting to threats. ideally, it empowers you to consistently meet business goals while overcoming challenges in your industry. an erm provides a structured and adaptable set of guidelines for use in various scenarios. Coso releases new guidance, compliance risk management: applying the coso erm framework, detailing the application of the enterprise risk management—integrating with strategy and performance (erm framework) to the management of compliance risks. the guidance was commissioned by coso and authored by the society of corporate compliance and. Enterprise risk management. in keeping with its overall mission, the coso board commissioned and published in 2004 enterprise risk management—integrated framework. over the past decade, that publication has gained broad acceptance by organizations in their efforts to manage risk. however, also through that period, the complexity of risk has. The original coso enterprise risk management framework is a widely accepted framework used by boards and management to enhance an organization's ability to manage uncertainty, consider how much risk to accept, and improve understanding of opportunities as it strives to increase and preserve.stakeholder value.

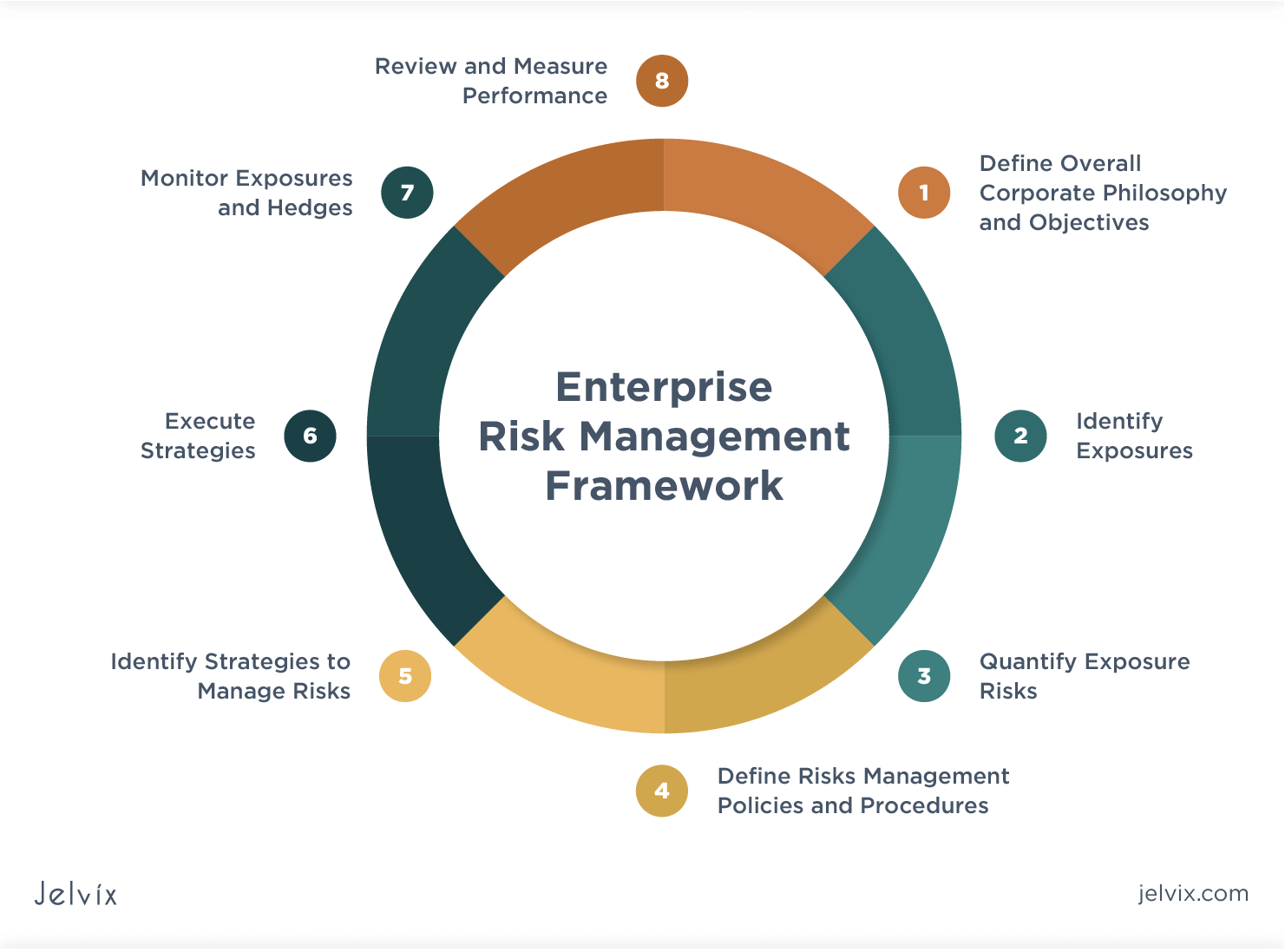

What Is Enterprise Risk Management Jelvix Enterprise risk management. in keeping with its overall mission, the coso board commissioned and published in 2004 enterprise risk management—integrated framework. over the past decade, that publication has gained broad acceptance by organizations in their efforts to manage risk. however, also through that period, the complexity of risk has. The original coso enterprise risk management framework is a widely accepted framework used by boards and management to enhance an organization's ability to manage uncertainty, consider how much risk to accept, and improve understanding of opportunities as it strives to increase and preserve.stakeholder value. The first step in creating an enterprise risk management diagram is to identify and categorize the various risks that the organization may face. this can include financial risks, operational risks, strategic risks, compliance risks, and more. by categorizing the risks, it becomes easier to analyze and prioritize them. 2. Risk and opportunity. in the 2004 publication enterprise risk management—integrated framework: executive summary framework, the committee of sponsoring organizations of the treadway commission (coso) stat ed that erm is: • “a process, ongoing and flowing through an entity • effected by people at every level of an organization.

Enterprise Risk Management Framework Download Now The first step in creating an enterprise risk management diagram is to identify and categorize the various risks that the organization may face. this can include financial risks, operational risks, strategic risks, compliance risks, and more. by categorizing the risks, it becomes easier to analyze and prioritize them. 2. Risk and opportunity. in the 2004 publication enterprise risk management—integrated framework: executive summary framework, the committee of sponsoring organizations of the treadway commission (coso) stat ed that erm is: • “a process, ongoing and flowing through an entity • effected by people at every level of an organization.

Comments are closed.