Ebl Feature Consumer Arbitration Clauses

Ebl Feature Consumer Arbitration Clauses A clause restricting the consumer’s avenue of redress to arbitration, while allowing the company the choice to litigate would also be invalid for the same reason.31 the courts have held in several decisions32 that an arbitration agreement in a consumer contract that forces the consumer to incur excessive arbitration fees is unconscionable. 24. 4 see, e.g., green tree financial corp. v. randolph, 531 u.s. 79 (2000); mandatory arbitration clauses: proposals for reform of consumer defendant arbitration, 122 harv. l. rev 1170 (2009) (“over the past twenty years, the supreme court has made arbitration agreements easier to enforce and arbitration proceedings harder to review.”).

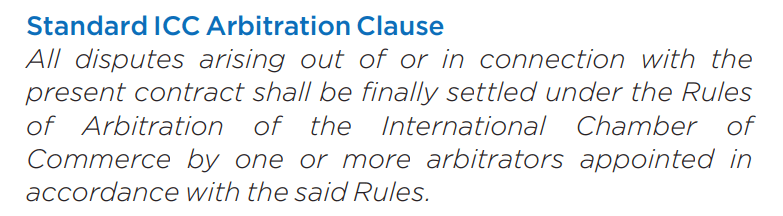

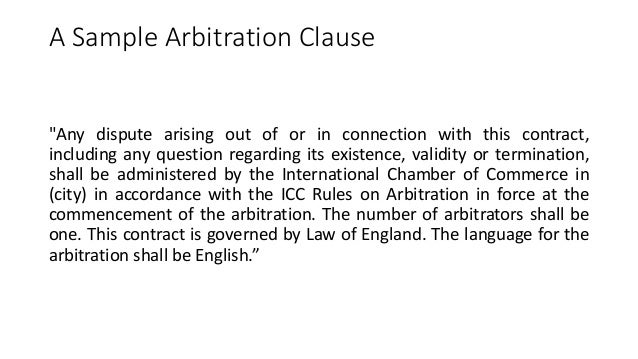

Drafting An Arbitration Clause In 2021 вђ Recommendations Aceris Law Llc The consumer arbitration rules (“rules”) to arbitration clauses in agreements between individual consumers and businesses where the business has a standardized, systematic application of arbitration clauses with customers and where the terms and conditions of the purchase of standardized, consumable. Mandatory arbitration clauses are contractual provisions that require parties to resolve disputes through arbitration rather than through the court system. these clauses are often found in the fine print of consumer contracts for various products and services, including credit cards, cell phone plans, and employment agreements. More recently, the consumer financial protection bureau (cfpb) proposed a new rule regulating mandatory arbitration clauses in certain financial products (arbitration agreements, 12 c.f.r. § 1040, 2017). understanding arbitration design in the financial industry, therefore, has direct policy relevance. initial findings. That plan seems to be paying off. an estimated 825 million consumer arbitration agreements were in force in 2018. yet only about 7,000 arbitration cases are actually heard each year, according to.

Drafting Arbitration Clause More recently, the consumer financial protection bureau (cfpb) proposed a new rule regulating mandatory arbitration clauses in certain financial products (arbitration agreements, 12 c.f.r. § 1040, 2017). understanding arbitration design in the financial industry, therefore, has direct policy relevance. initial findings. That plan seems to be paying off. an estimated 825 million consumer arbitration agreements were in force in 2018. yet only about 7,000 arbitration cases are actually heard each year, according to. The aaa ® provides for fair administration of consumer disputes— and will exercise its authority to decline administration of arbitration demands where an arbitration clause contains material violations of the aaa consumer due process protocol, developed in 1998 in cooperation with representatives from government agencies, consumer interest groups, education institutions, and businesses. Consumers won some relief in 53.3% of the cases they filed and recovered an average of $19,255; business claimants won some relief in 83.6% of their cases and recovered an average of $20,648. the upfront cost of arbitration for consumer claimants in cases administered by the aaa appears to be quite low. in cases with claims seeking less than.

Drafting Arbitration Clauses An Institutional Perspective Employee The aaa ® provides for fair administration of consumer disputes— and will exercise its authority to decline administration of arbitration demands where an arbitration clause contains material violations of the aaa consumer due process protocol, developed in 1998 in cooperation with representatives from government agencies, consumer interest groups, education institutions, and businesses. Consumers won some relief in 53.3% of the cases they filed and recovered an average of $19,255; business claimants won some relief in 83.6% of their cases and recovered an average of $20,648. the upfront cost of arbitration for consumer claimants in cases administered by the aaa appears to be quite low. in cases with claims seeking less than.

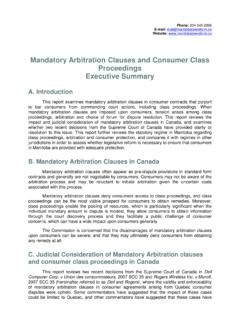

Mandatory Arbitration Clauses And Consumer Class Mandatory

Comments are closed.