Digital Payment System How It Works

Digital Payment System How It Works Youtube Digital wallets work in a similar way to physical wallets, by storing user payment information and passwords in the cloud. they’re typically used on mobile devices but can also be stored on. A digital payment transaction can happen both on the internet and in person to the payee. working of digital payments system. to understand the process of how digital payments work, let’s.

Digital Payment System How It Works Ppt Presentation Video Youtube Digital wallets are one such method. they store your payment options, such as credit and debit cards, allowing you to conveniently use your smartphone or smartwatch to make a purchase. credit and. The global digital payments market is expected to grow at a cagr of 20.5% through 2030. digital and mobile wallets are expected to account for more than half (51.7%) of e commerce payment methods worldwide by 2024. the digital payments market was valued at usd 7.36 trillion in 2021, and it is projected to be worth usd 15.27 trillion by 2027. Types of digital payment. there has been a major increase in the number of digital payment solutions over the last few years, which have made life easier for both merchants and customers. mobile wallets. if the customer uses a digital wallet system like apple pay on their smartphone or banking app, there is no need for a middle person. Payment methods include bank transfers, credit or debit cards, and digital wallets. payment processor. facilitates the credit card transaction by sending payment information between the merchant, the issuing bank, and the acquirer. the payment processor usually gets the payment details from a payment gateway. pci data security standards (pci dss).

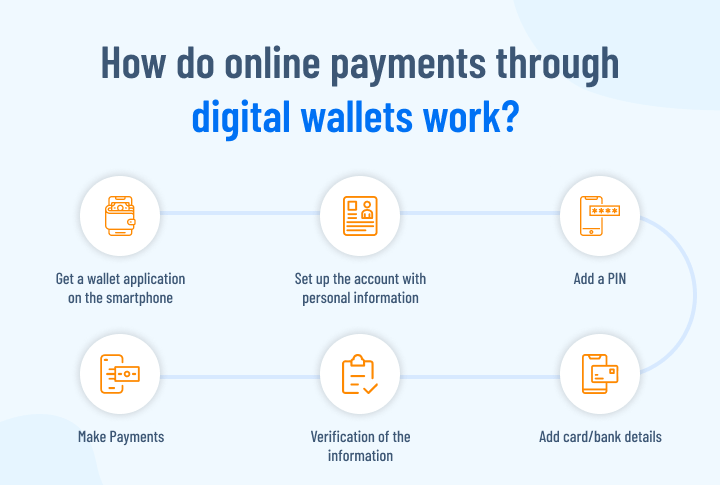

Understanding How Digital Wallet Online Payments Works Types of digital payment. there has been a major increase in the number of digital payment solutions over the last few years, which have made life easier for both merchants and customers. mobile wallets. if the customer uses a digital wallet system like apple pay on their smartphone or banking app, there is no need for a middle person. Payment methods include bank transfers, credit or debit cards, and digital wallets. payment processor. facilitates the credit card transaction by sending payment information between the merchant, the issuing bank, and the acquirer. the payment processor usually gets the payment details from a payment gateway. pci data security standards (pci dss). The digital payment system: how it works? the ecosystem of digital payments encompasses various technologies, platforms, and digital payment services that enable individuals and businesses to conduct transactions electronically. to understand how digital payments work, we need to examine the participants of this process. 2. the digital payment is authorized . the payment processor contacts the customer’s bank for authorization. the processor verifies that there are sufficient funds in the customer's account and that the digital payment transaction meets security requirements (such as the payee’s identity matching the name of the bank account holder).

Payments 101 How Online Payment Processing Works Rapyd The digital payment system: how it works? the ecosystem of digital payments encompasses various technologies, platforms, and digital payment services that enable individuals and businesses to conduct transactions electronically. to understand how digital payments work, we need to examine the participants of this process. 2. the digital payment is authorized . the payment processor contacts the customer’s bank for authorization. the processor verifies that there are sufficient funds in the customer's account and that the digital payment transaction meets security requirements (such as the payee’s identity matching the name of the bank account holder).

How Unified Payment Interface Works Digital Uncovered

Comments are closed.