Credit Trends Report February 9 2021 Portfolio Equifax

Credit Trends Report February 9 2021 Portfolio Equifax 25. uto loan portfolio observations as of february 2021:the number of outstanding auto loan accoun. has decreased 0.6% over a year ago to 79.15 million.total outstanding balances on auto loans. ave increased 3.6% year over year to $1.301 trillion.the severe delinquency rate (share of balances 60 dpd) in feb. And leases, 31.9% is from student loans, and 22.8% is from credit card balances. looking back ten years to february 2014, 30.4% of non mortgage debt was from auto loans and leases, 37.5% was from student loans, and 22.2% was from.

Credit Trends Report February 9 2021 Accommodations Equifaxођ Monthly u.s. national consumer credit trends report: january 2021 portfolio. data as of january 2021 . report date: february 16, 2021. consumer debt observations as of january 2021: total us consumer debt is $14.55 trillion, up 2.9% over a year ago. mortgage debt, including home equity loans, accounts for $10.44 trillion, a 71.8% share of. Umer debt is $16.85 trillion, up 9.0% over a year ago. mortgage debt, including home equity loans, acc. unts for $12.17 trillion, a 72.2% share of total debt. non mortgage. ebt totals $4.68 trillion, equating to a 27.8% share.in december 2022, 33.6% of non mortgage consumer debt is from auto loans and leases, 35.3% is from. The report is based on data from the new york fed's nationally representative consumer credit panel. mortgage balances rose by $254 billion in the fourth quarter of 2022 and stood at $11.92 trillion at the end of december, marking a nearly $1 trillion increase in mortgage balances in 2022. Equifax and its business environment. all statements that address operating performance and events or developments that we expect or anticipate will occur in the future, including statements relating to future operating results, improvements in our it and data security.

Q3 2021 Consumer Credit Trends Infographic Equifax The report is based on data from the new york fed's nationally representative consumer credit panel. mortgage balances rose by $254 billion in the fourth quarter of 2022 and stood at $11.92 trillion at the end of december, marking a nearly $1 trillion increase in mortgage balances in 2022. Equifax and its business environment. all statements that address operating performance and events or developments that we expect or anticipate will occur in the future, including statements relating to future operating results, improvements in our it and data security. The amount of outstanding commercial real estate (cre) loans held by banks doubled from about $1.4 trillion to about $3 trillion from january 2012 through january 2024. cre loans are generally used to acquire, develop, construct, improve, or refinance real property, such as office, multifamily, or retail properties. Leases, 34.9% is from student loans, and 20.9% is from credit card balances. looking back ten years to march 2013, 30.1% of non mortgage debt was from auto loans and leases, 36.4% was from student loans, and 23.1% was from.

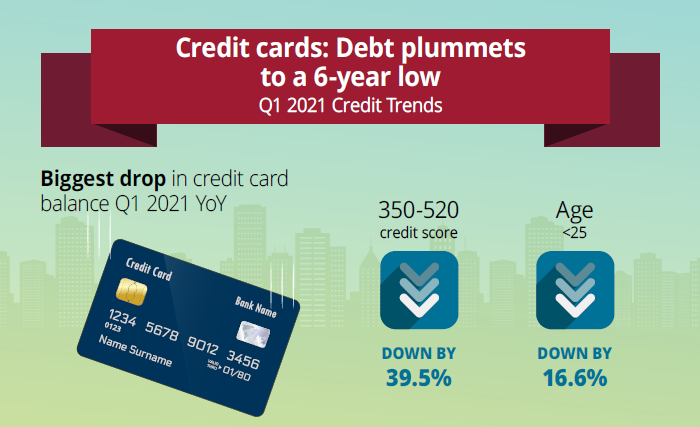

Q1 2021 Credit Card Trends Infographic Infographic Equifax The amount of outstanding commercial real estate (cre) loans held by banks doubled from about $1.4 trillion to about $3 trillion from january 2012 through january 2024. cre loans are generally used to acquire, develop, construct, improve, or refinance real property, such as office, multifamily, or retail properties. Leases, 34.9% is from student loans, and 20.9% is from credit card balances. looking back ten years to march 2013, 30.1% of non mortgage debt was from auto loans and leases, 36.4% was from student loans, and 23.1% was from.

Credit Trends Report February 9 2021 Originations Equifax

Comments are closed.