Consumer Impact Recovery Debt Collection

Understanding The Debt Collection Process Credit Card Help 4u Description. this person, nola brown, from a company called consumer impact recovery claimed i owed money, $350 from a payday loan through ez money ez corp from 2016. A legitimate debt collector can tell you their company name and mailing address, as well as information about the debt they say you owe. the debt collector should provide information about themselves and their collection agency. this can be a helpful way to know more about the debt, as well as tell whether or not it’s a scam. to verify a debt.

How Do Debt Collections Impact Your Credit Score Enterslice Before disclosing any information, look for these eight signs of a fake debt collection scam. 1. the contact information is suspicious. legitimate debt collectors will typically offer contact. About us. we're the consumer financial protection bureau (cfpb), a u.s. government agency that makes sure banks, lenders, and other financial companies treat you fairly. learn how the cfpb can help you. call us if you still can’t find what you’re looking for. (855) 411 2372. A debt collector must tell you information such as the name of the creditor, the amount owed, and that if you dispute the debt the debt collector will have to obtain verification of the debt. if the debt collector does not provide this information during the initial contact with you, they are required to send you a written notice within five. 1. find out who’s calling. get the name of the collector, the collection company, its address, and phone number. 2. get “validation” information about the debt. within 5 days of first contacting you, debt collectors must “validate” or tell you the amount of the debt, the name of the current creditor, and how to get the name of the.

Debt Collection And Recovery Anthony Joyce Co A debt collector must tell you information such as the name of the creditor, the amount owed, and that if you dispute the debt the debt collector will have to obtain verification of the debt. if the debt collector does not provide this information during the initial contact with you, they are required to send you a written notice within five. 1. find out who’s calling. get the name of the collector, the collection company, its address, and phone number. 2. get “validation” information about the debt. within 5 days of first contacting you, debt collectors must “validate” or tell you the amount of the debt, the name of the current creditor, and how to get the name of the. Ftc action results in ban for richmond capital and owner from merchant cash advance and debt collection industries and return of more than $2.7m to consumers (june 6, 2022 ) federal trade commission returns more than $255,000 to consumers harmed by abusive debt collector vantage point services (may 31, 2022 ). Partnering with ic system simplifies the process in two ways: customizable programs that are easily adjusted to meet your unique business needs. choose from two options based on your unique needs: our two stage recovery plus program or our low contingency insticollect. an ethical, consumer friendly approach to debt collection that prioritizes.

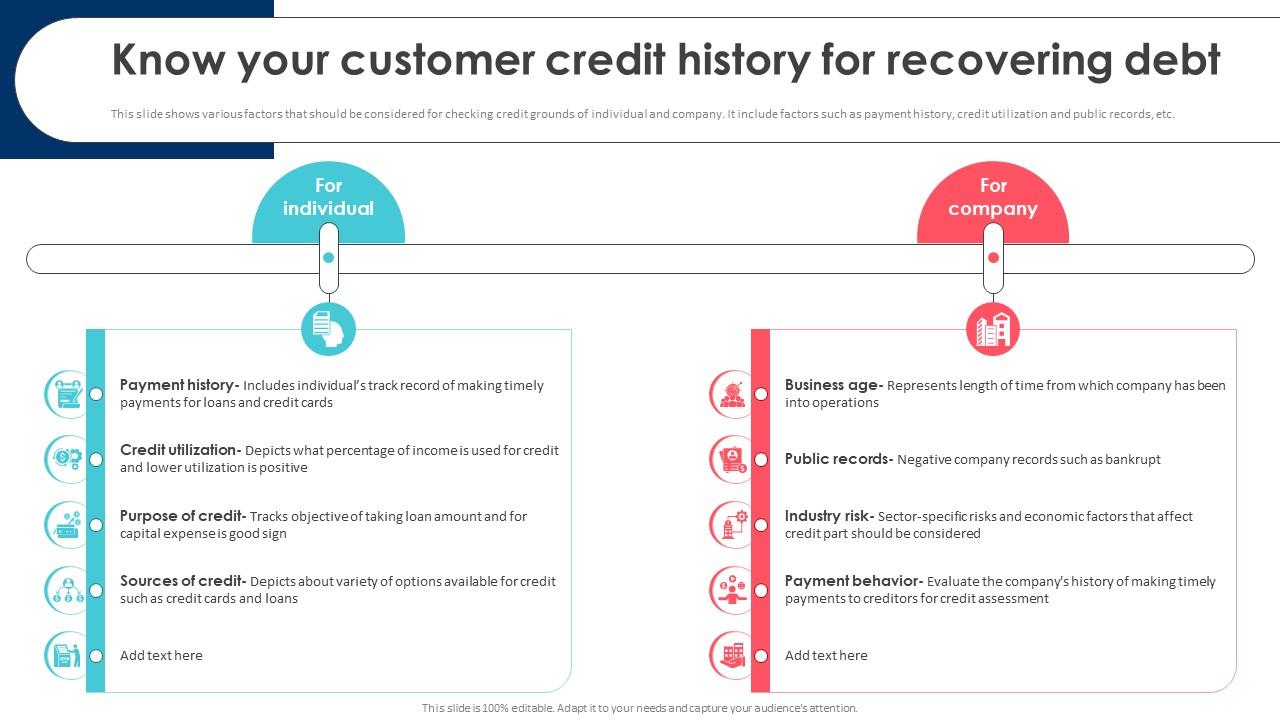

Debt Recovery Process Know Your Customer Credit History For Recovering De Ftc action results in ban for richmond capital and owner from merchant cash advance and debt collection industries and return of more than $2.7m to consumers (june 6, 2022 ) federal trade commission returns more than $255,000 to consumers harmed by abusive debt collector vantage point services (may 31, 2022 ). Partnering with ic system simplifies the process in two ways: customizable programs that are easily adjusted to meet your unique business needs. choose from two options based on your unique needs: our two stage recovery plus program or our low contingency insticollect. an ethical, consumer friendly approach to debt collection that prioritizes.

Comments are closed.