Consumer Behavior Statistics

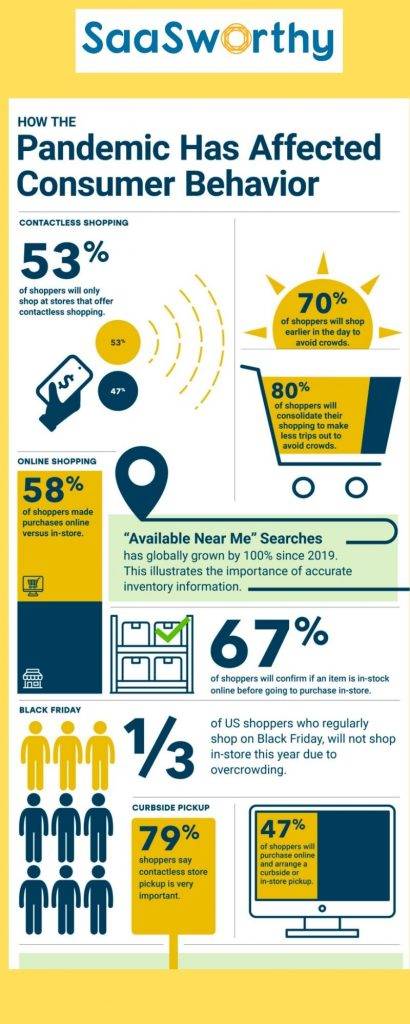

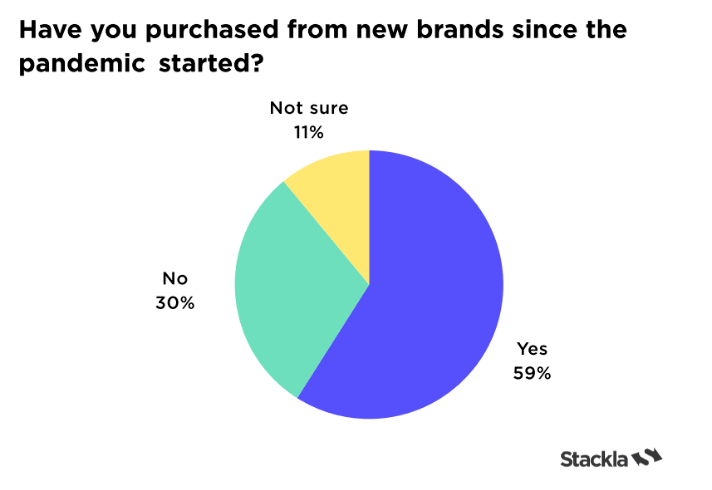

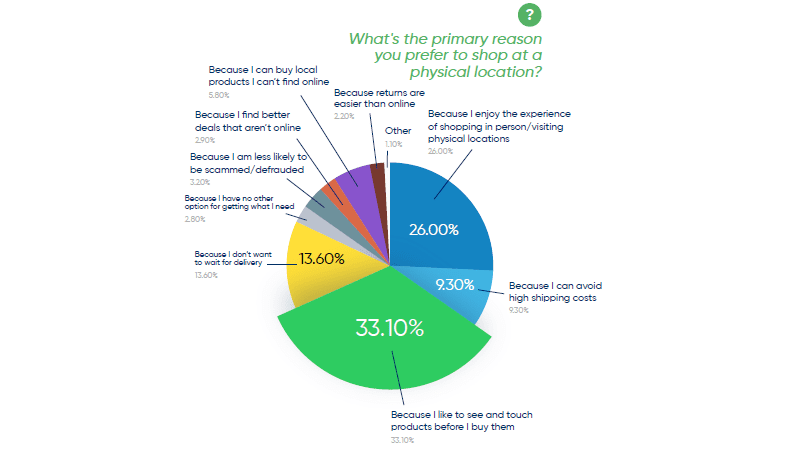

Consumer Behavior Statistics In 2022 Saasworthy Blog But, the rapid shift showed us that the factors influencing consumer purchasing decisions are always changing. in this piece, i’ll go over consumer behavior statistics i’ve pulled from our 2024 consumer trends repor t to explain what’s driving consumers this year. consumer behavior stats 1. social shopping is an ecommerce standard. Products shoppers would buy at the same rate during a recession in the u.s. 2023. consumer goods consumers would buy at the same rate during a recession in the united states in 2023, by product.

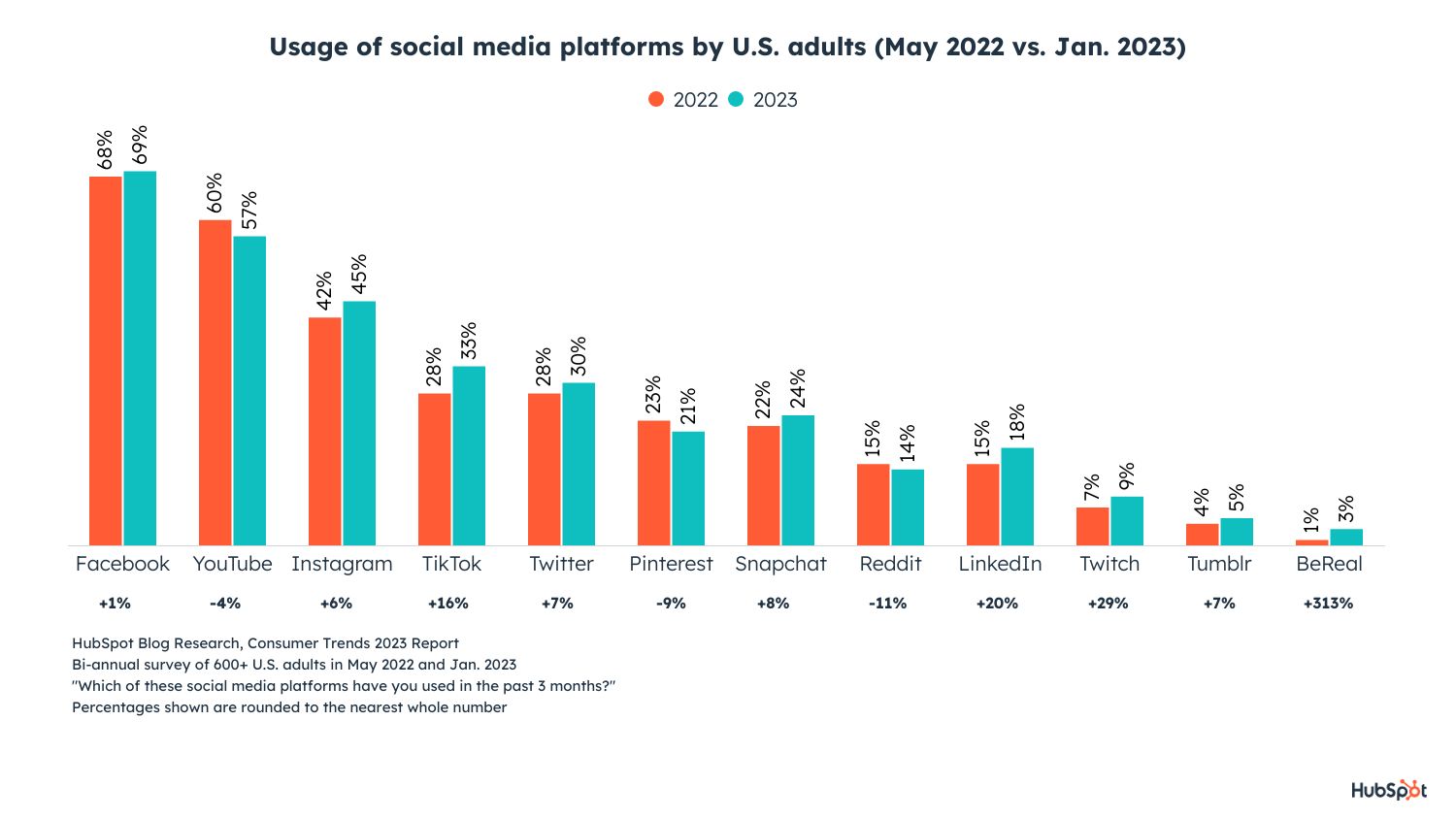

The 4 Biggest Consumer Behavior Shifts Of 2023 According To New Data In the early months of 2022, amid record inflation, us consumers continued to open their wallets. us inflation grew to nearly 8.5 percent in march 2022, with the may 2021 to march 2022 period showing the highest inflation in a decade. yet, us consumers spent 18 percent more in march 2022 than they did two years earlier, and 12 percent more than. Consumer businesses that market exclusively to younger consumers are thus missing out; they ignore wealthy aging consumers at their own risk. 3. the squeezed but splurging middle. we expect that cost of living increases in advanced economies will continue to put pressure on middle income consumers. In the second quarter of 2024, us consumer optimism fell, mirroring levels seen at the end of 2023. economic pessimism grew slightly, fueled by concerns over inflation, the depletion of personal savings, and perceived weakness in the labor market. these concerns left consumers somewhat conflicted: on one hand, they continued to splurge on food. The changes in consumer behavior and financial well being presented here only reflect a snapshot in time, and future developments will depend on individual and state responses to changes in the incidence of covid 19 cases. the main findings of our analysis are as follows: tough times for younger respondents. meeting expenses was more difficult.

Consumer Behavior Stats 2021 The Post Pandemic Shift In Online In the second quarter of 2024, us consumer optimism fell, mirroring levels seen at the end of 2023. economic pessimism grew slightly, fueled by concerns over inflation, the depletion of personal savings, and perceived weakness in the labor market. these concerns left consumers somewhat conflicted: on one hand, they continued to splurge on food. The changes in consumer behavior and financial well being presented here only reflect a snapshot in time, and future developments will depend on individual and state responses to changes in the incidence of covid 19 cases. the main findings of our analysis are as follows: tough times for younger respondents. meeting expenses was more difficult. Subscribe to stay on top of changing consumer behavior trends. deloitte’s financial well being index rose for a third consecutive month, reaching a four year high of 102.6 in july 2024 (figure 1). higher income americans appear to be driving the recent improvements in financial sentiment. since september 2022, the percentage of higher income. For 2023's holiday shopping season, for example, millennials planned to spend an average of nearly 2,000 u.s. dollars, while gen z consumers intended to spend under 1,300 u.s. dollars per capita.

25 Stats On Consumer Shopping Trends To Know For 2022 Subscribe to stay on top of changing consumer behavior trends. deloitte’s financial well being index rose for a third consecutive month, reaching a four year high of 102.6 in july 2024 (figure 1). higher income americans appear to be driving the recent improvements in financial sentiment. since september 2022, the percentage of higher income. For 2023's holiday shopping season, for example, millennials planned to spend an average of nearly 2,000 u.s. dollars, while gen z consumers intended to spend under 1,300 u.s. dollars per capita.

Comments are closed.