Commodity Indices And Futures Markets Agricultural Economics

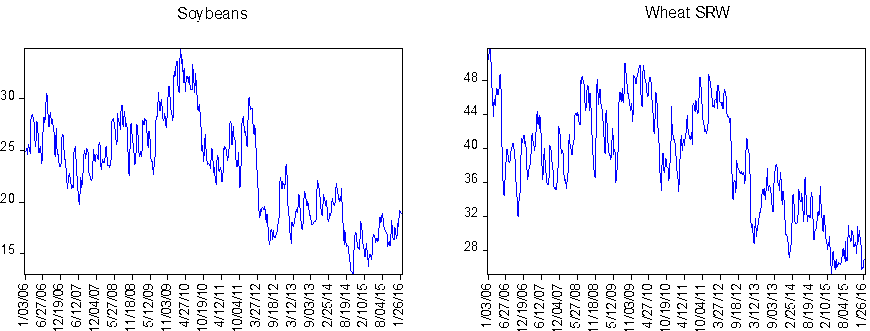

Commodity Indices And Futures Markets Agricultural Economics Cornhusker economics february 10, 2016 commodity indices and futures markets the beginning of the year always brings news about commodity indices, particularly the annual changes in their composition. actually, the rebalancing of several indices has been in the news for the last few months. The lack of a direct empirical link between index fund trading and commodity futures prices casts considerable doubt on the belief that index funds fueled a price bubble. key words: index funds, commodity, futures markets, prices, specu lation, bubble. jel codes: d84, g12, g13, g14, q13, q41.

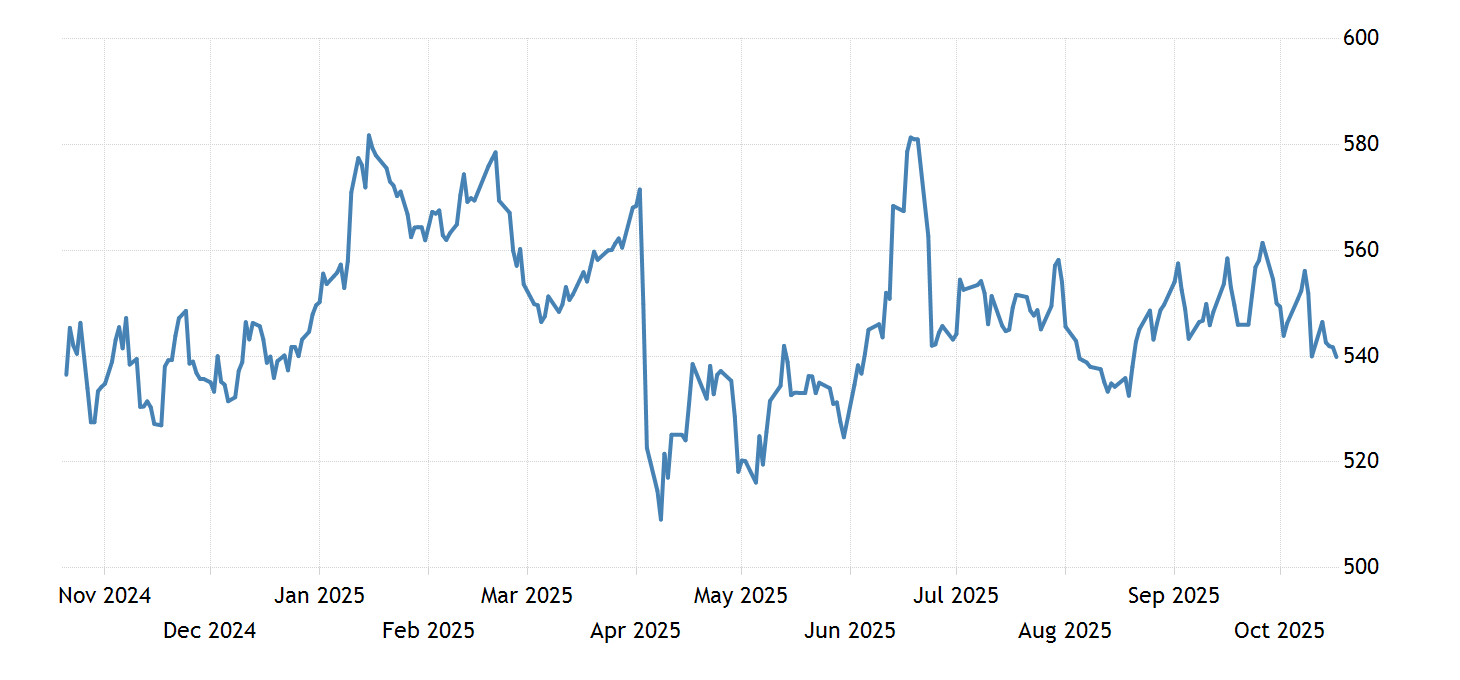

Commodity Indices And Futures Markets Agricultural Economics The lack of a direct empirical link between index fund trading and commodity futures prices casts considerable doubt on the belief that index funds fueled a price bubble. references ai, chunrong , chatrath, arjun , and song, frank , on the comovement of commodity prices american journal of agricultural economics 2006 88 3 574 – 88. American journal of agricultural economics publishes work on the economics of agriculture, natural resources, and rural development throughout the world. abstract this paper investigates the role of futures markets and their dynamic effects on the stability of commodity prices. The bloomberg commodities index, known as bcom, is a leading commodities benchmark providing broad based exposure to commodities, without a single commodity or commodity sector dominating the index. bcom is constructed using 24 of the most traded commodities futures contracts across six sectors, reweighted and rebalanced annually on a price. Price chart historical data news. gsci increased 3.22 points or 0.61% since the beginning of 2024, according to trading on a contract for difference (cfd) that tracks the benchmark market for this commodity. historically, gsci commodity index reached an all time high of 1718.63 in july of 2008.

Agricultural Commodity Futures And Market Efficiency Abhijeet The bloomberg commodities index, known as bcom, is a leading commodities benchmark providing broad based exposure to commodities, without a single commodity or commodity sector dominating the index. bcom is constructed using 24 of the most traded commodities futures contracts across six sectors, reweighted and rebalanced annually on a price. Price chart historical data news. gsci increased 3.22 points or 0.61% since the beginning of 2024, according to trading on a contract for difference (cfd) that tracks the benchmark market for this commodity. historically, gsci commodity index reached an all time high of 1718.63 in july of 2008. Motivated by repeated price spikes and crashes over the last decade, weinvestigate whether the growing market shares of futures speculatorsdestabilize commodity spot prices. we approximate conditional volatility andanalyze how it is affected by speculative open interest. The first decade of the 21 st century has perhaps witnessed morestructural change in commodity futures markets than all previous decadescombined. not only have trading volumes and open interest increasedmarkedly, but this time period also saw historic changes in both trading andparticipants.

Agricultural Commodities Learn How To Trade Them At Commodity Motivated by repeated price spikes and crashes over the last decade, weinvestigate whether the growing market shares of futures speculatorsdestabilize commodity spot prices. we approximate conditional volatility andanalyze how it is affected by speculative open interest. The first decade of the 21 st century has perhaps witnessed morestructural change in commodity futures markets than all previous decadescombined. not only have trading volumes and open interest increasedmarkedly, but this time period also saw historic changes in both trading andparticipants.

Gsci Commodity Index 1969 2021 Data 2022 2023 Forecast Price

Comments are closed.