Chart Of The Day Cpi Ppi Divergence

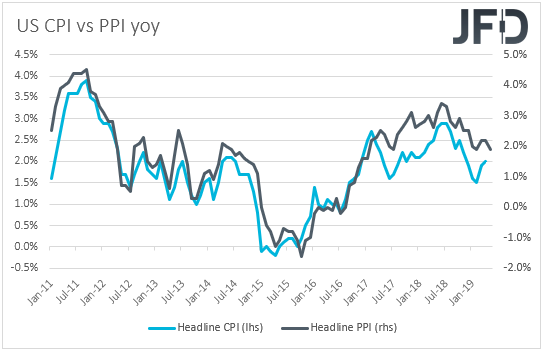

Chart Of The Day Cpi Ppi Divergence Turkish cpi – ppi spread currently stands at 26.4, while the average divergence since 1995 is 0.33; u.s. cp i – ppi spread currently stands at 6.4, which is the largest divergence since the start of the data set in 1991 and well above the average of 0.32; china cpi – ppi spread is at 12.0, which is again the largest divergence in the. As the chart shows, this is like nothing we’ve seen in the last 25 years. in fact, at the moment this divergence has a z score of 6.5, a reading this high is extremely rare. ultimately, cpi will likely narrow the gap with ppi and provide consternation for the ecb, whose policy makers have been relying on the other global central banks to do.

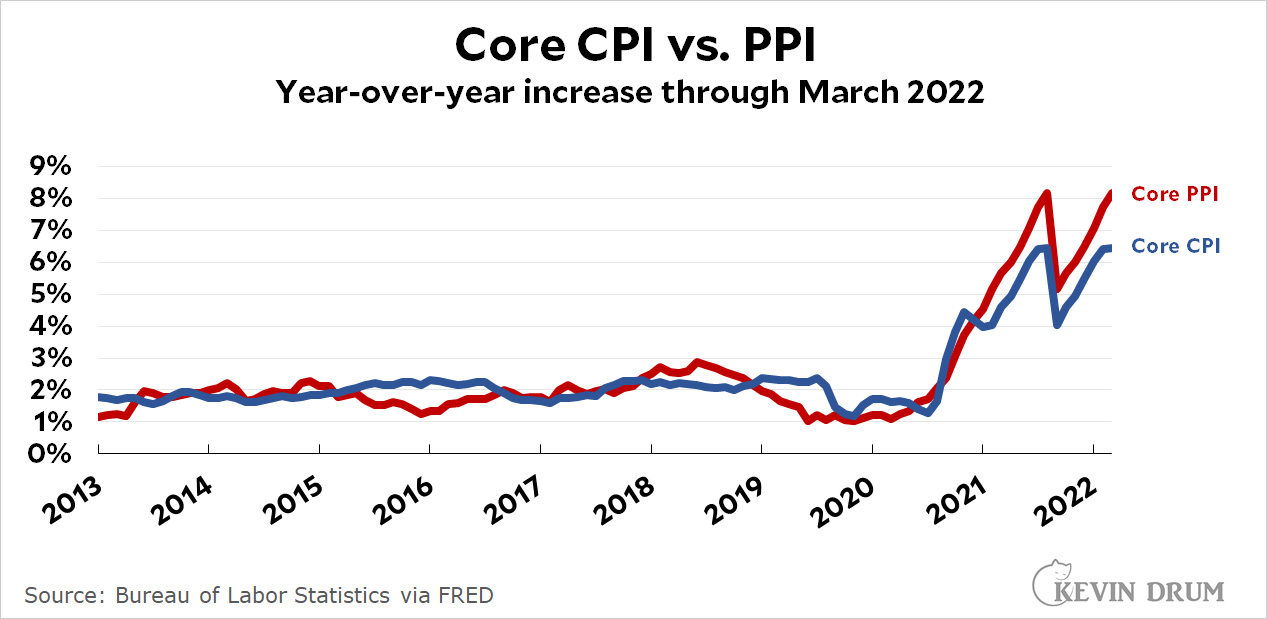

Chart Of The Day Cpi Ppi Divergence Similarity Going Back 1973 Chart of the day: cpi ppi divergence. below is a chart and brief excerpt from today's early look written by hedgeye ceo keith mccullough. and asian bond yields fell on the “unexpected” disinflationary news. stocks rallied, taking the shanghai composite index right back up to the particularly important @hedgeye trend level of 3591. The divergence in the price level of services has been even more dramatic. before the pandemic the growth of the overall ppi averaged a little lower than the growth in cpi. but since 2021 the divergence has exploded: ppi has averaged 2.7% higher than cpi and rose to 3.6% in march. sorry for this number ific post. there's just a lot to see here. One doesn’t lead the other. exhibit 1: cpi and ppi march hand in hand. source: st. louis federal reserve, as of 2 15 2022. consumer price index (all items, us city average) and producer price index: final demand, november 2010 – january 2022. the headline ppi, known as final demand ppi, isn’t that old. but the legacy ppi for all. The consumer price index (cpi) measures the cost of a fixed bundle of consumer goods relative to the cost of those same goods in a chosen reference year. inflation is the percent change in the index from one year to the next and reflects how prices are changing for consumers. the producer price index (ppi) is a similar construct that measures.

Ppi Vs Cpi Chart One doesn’t lead the other. exhibit 1: cpi and ppi march hand in hand. source: st. louis federal reserve, as of 2 15 2022. consumer price index (all items, us city average) and producer price index: final demand, november 2010 – january 2022. the headline ppi, known as final demand ppi, isn’t that old. but the legacy ppi for all. The consumer price index (cpi) measures the cost of a fixed bundle of consumer goods relative to the cost of those same goods in a chosen reference year. inflation is the percent change in the index from one year to the next and reflects how prices are changing for consumers. the producer price index (ppi) is a similar construct that measures. The personal consumption expenditures price index — which is the fed's preferred price index — registered 6.3 percent on a year over year basis, more than triple the fed's long run average target of 2 percent. the producer price index (ppi) — which measures prices charged by u.s. businesses — has risen to a year over year rate of 9.7. Divergence day trading is a strategy for predicting trend reversals. by looking at the right set of data, you can make an educated guess about future price momentum. this applies whether the trend is currently bullish or bearish. there are a few popular indicators to track. more on those in a bit.

Ppi Vs Cpi Chart The personal consumption expenditures price index — which is the fed's preferred price index — registered 6.3 percent on a year over year basis, more than triple the fed's long run average target of 2 percent. the producer price index (ppi) — which measures prices charged by u.s. businesses — has risen to a year over year rate of 9.7. Divergence day trading is a strategy for predicting trend reversals. by looking at the right set of data, you can make an educated guess about future price momentum. this applies whether the trend is currently bullish or bearish. there are a few popular indicators to track. more on those in a bit.

Chart Of The Day The Producer Price Index Vs The Consumer Price Index

Comments are closed.