Certificate Of Deposit Definition Example Cd Advantag Vrogue

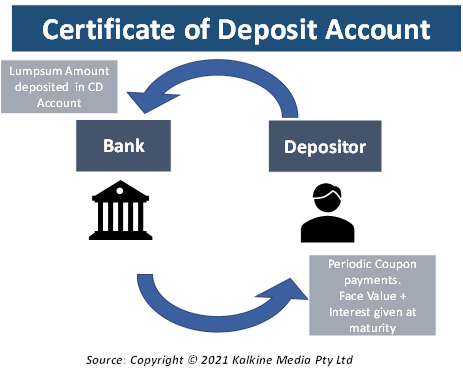

Certificate Of Deposit Cd Definition Types Examples Vrogue Co A certificate of deposit (cd) is a type of savings account that pays a fixed interest rate on money held for an agreed upon period of time. cd rates are usually higher than savings accounts, but. A certificate of deposit (cd) is one banking tool you can use to grow your savings. definition of cd. cds are interest earning bank accounts. cds work by paying you interest on the money in.

Certificate Of Deposit Cd Definition Types Examples Vrogue Co A cd is a type of account offered by banks and credit unions that pays interest on your money for a set period of time. these accounts pay a guaranteed rate of return. cds sometimes offer a better. A jumbo certificate of deposit is a cd that has a larger minimum deposit, which is $100,000, compared to regular cds. traditional certificates of deposit typically have a minimum deposit of $2,500. There are several reasons why you may consider using a cd for managing your savings goals. here are some of the main benefits or advantages of saving money with certificate of deposit accounts. 1. A certificate of deposit (cd) is a time based savings product offered by banks and credit unions that allows individuals to deposit money for a specified term and earn interest. cds differ from other savings options in terms of liquidity, risk, and potential returns, as they typically have higher interest rates than traditional savings accounts.

Certificate Of Deposit Definition Example Cd Advantag Vrogue Co There are several reasons why you may consider using a cd for managing your savings goals. here are some of the main benefits or advantages of saving money with certificate of deposit accounts. 1. A certificate of deposit (cd) is a time based savings product offered by banks and credit unions that allows individuals to deposit money for a specified term and earn interest. cds differ from other savings options in terms of liquidity, risk, and potential returns, as they typically have higher interest rates than traditional savings accounts. Key takeaways. a certificate of deposit, or cd, is a deposit with a fixed interest rate held at a bank for a preset time period. there are 2 types of cds: bank cds, which you can buy directly from a bank, and brokered cds, which you can purchase through brokerages, like fidelity. unlike bank cds, brokered cds can be traded. What is a cd? a certificate of deposit, or cd, is a type of bank account that requires the account owner to agree to keep their money in the account for a certain period. for this reason, cds are.

:max_bytes(150000):strip_icc()/Certificate-of-deposit-264479c44e184cdfb5f1c19f7725399e.jpg)

What Is A Certificate Of Deposit Cd Pros And Cons Key takeaways. a certificate of deposit, or cd, is a deposit with a fixed interest rate held at a bank for a preset time period. there are 2 types of cds: bank cds, which you can buy directly from a bank, and brokered cds, which you can purchase through brokerages, like fidelity. unlike bank cds, brokered cds can be traded. What is a cd? a certificate of deposit, or cd, is a type of bank account that requires the account owner to agree to keep their money in the account for a certain period. for this reason, cds are.

Certificate Of Deposit Definition Example Cd Advantag Vrogue Co

Comments are closed.