Bloomberg Economics On Twitter Breaking The Fed Strengthened Their

Bloomberg Economics On Twitter Breaking The Fed Strengthened Their Connecting decision makers to a dynamic network of information, people and ideas, bloomberg quickly and accurately delivers business and financial information, news and insight around the world. Holder: when the fed lowers interest rates, it can mean more money in people’s pockets, mortgage rates can drop, and credit card interest rates can come down. now interest rates in the us don’t just affect the housing market and consumer spending. they have a massive impact on the us economy and the global economy. more on that after the break.

Bloomberg Economics On Twitter Pmi Data Fed Minutes Rbnz Mark June 26, 2024 at 10:33 am edt. save. the dollar rose to its highest level since november amid speculation that the federal reservewill break with other central banks by keeping interest rates. Tom brenner reuters. the federal reserve cut interest rates on wednesday by half a percentage point. here are some takeaways from the decision and from remarks by the fed chair, jerome h. powell. The fed’s favorite inflation gauge — the personal consumption expenditures price index — registered at an annual rate of 2.5% in june, down markedly from 7.1% just two years ago. powell in. July 19, 2024 at 9:00 am edt. save. economists trimmed their us inflation projections through the first half of 2025 and see a slightly higher unemployment rate, a combination they expect will.

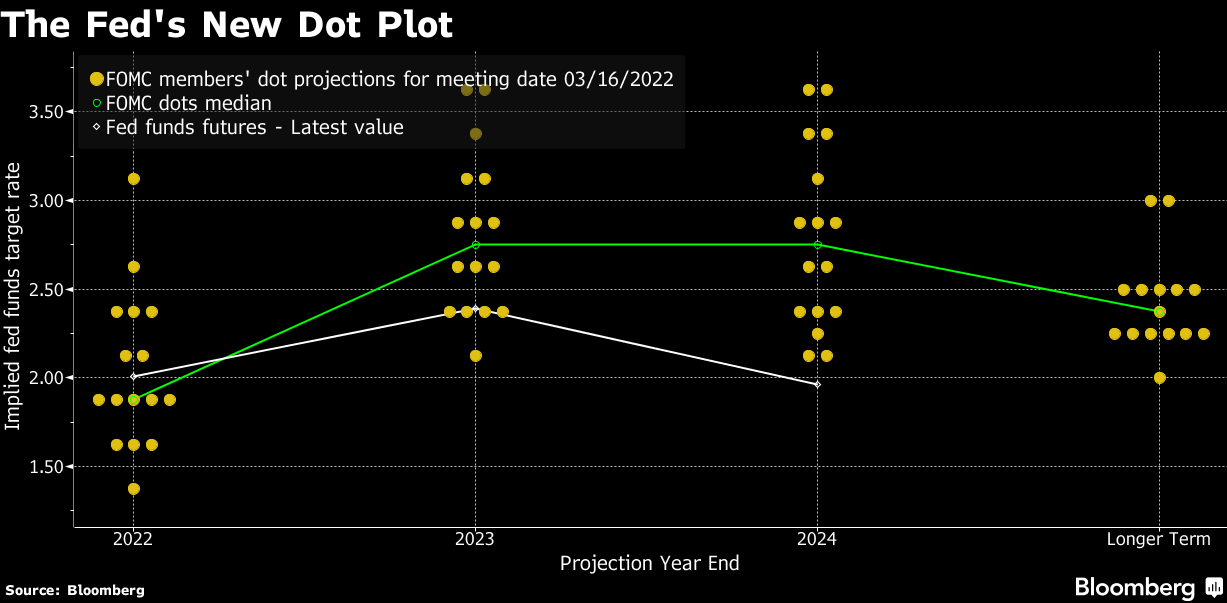

Bloomberg Economics On Twitter The Fed S New Dot Plot Shows Officials The fed’s favorite inflation gauge — the personal consumption expenditures price index — registered at an annual rate of 2.5% in june, down markedly from 7.1% just two years ago. powell in. July 19, 2024 at 9:00 am edt. save. economists trimmed their us inflation projections through the first half of 2025 and see a slightly higher unemployment rate, a combination they expect will. Updated 3:12 pm pdt, july 15, 2024. washington (ap) — chair jerome powell said monday that the federal reserve is becoming more convinced that inflation is headed back to its 2% target and said the fed would cut rates before the pace of price increases actually reached that point. “we’ve had three better readings, and if you average them. However, the realized rate for 2022 was 4.5 percent and the average expectation for 2023 was revised up to 4.7 percent by the end of 2022. hence, our summary measure for the shift in u.s. policy expectations in 2022 is Δpeus, 2022 = 0.5 × [(4.5– 0.75) (4.7– 1.55)] = 3.45 percentage points. table 1 reports the changes in policy.

Bloomberg Economics On Twitter The Fed S New Dot Plot Shows Officials Updated 3:12 pm pdt, july 15, 2024. washington (ap) — chair jerome powell said monday that the federal reserve is becoming more convinced that inflation is headed back to its 2% target and said the fed would cut rates before the pace of price increases actually reached that point. “we’ve had three better readings, and if you average them. However, the realized rate for 2022 was 4.5 percent and the average expectation for 2023 was revised up to 4.7 percent by the end of 2022. hence, our summary measure for the shift in u.s. policy expectations in 2022 is Δpeus, 2022 = 0.5 × [(4.5– 0.75) (4.7– 1.55)] = 3.45 percentage points. table 1 reports the changes in policy.

Comments are closed.