6 Things Credit Card Companies Must Clearly Disclose To Consumers

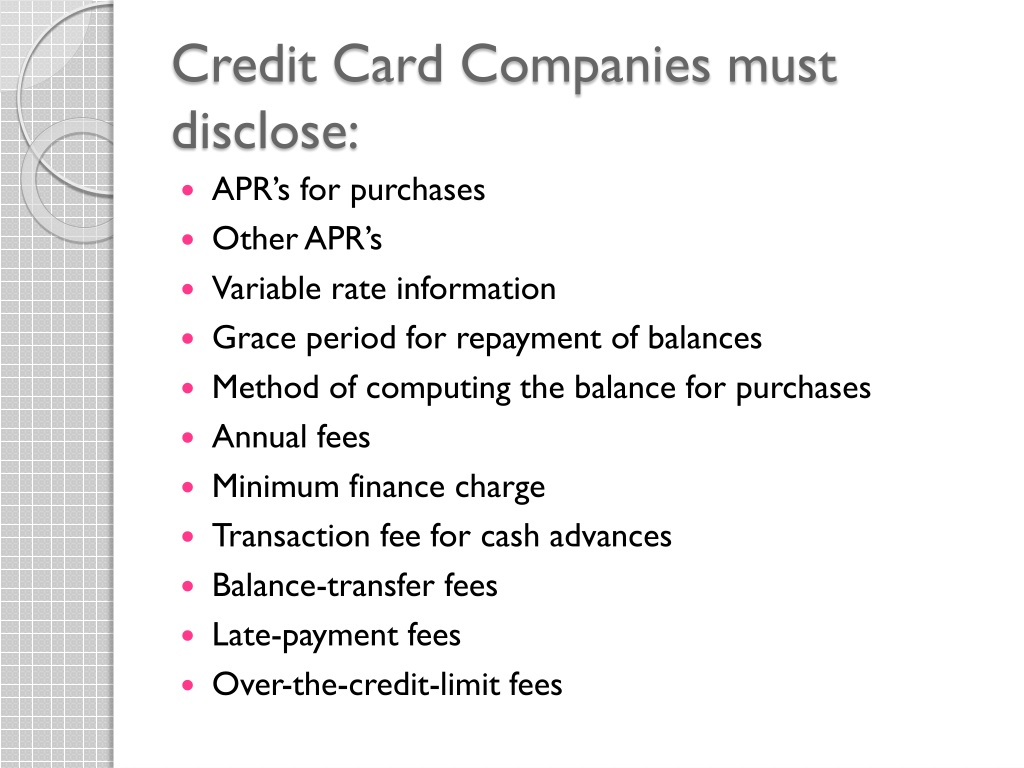

List At Least 6 Things Your Credit Card Company Must Clearlyо Lenders have to provide borrowers a truth in lending disclosure statement. it has handy information like the loan amount, the annual percentage rate (apr), finance charges, late fees, prepayment penalties, payment schedule and the total amount you’ll pay. the law also established a “right of recession” for certain types of home loans. List at least 6 things your credit card company must clearly disclose to consumers. under the truth in lending act (tila), credit card companies are obligated to transparently disclose crucial details to consumers, including the apr, finance charges, payment schedule, total repayment amount, grace period, and penalties, ensuring informed financial decision making.

What Must Be Included In The Disclosures For Credit Cards Leia Aqui The regulations found in the tila apply to most kinds of consumer credit, from mortgages to credit cards. lenders are required to clearly disclose information and certain details about their. Under the truth in lending act, credit card companies must clearly and fully disclose all information about any credit card offers and terms. this includes basic information such as the interest rate, annual percentage rate (apr), late fees, and annual fees. issuers must also clearly differentiate "intro" aprs or other promotional terms from. The truth in lending act, or tila, also known as regulation z, requires lenders to disclose information about all charges and fees associated with a loan. this 1968 federal law was created to promote honesty and clarity by requiring lenders to disclose terms and costs of consumer credit. the tila standardized the process of how borrowing costs. I. charge card accounts. for purposes of § 1026.5 (b) (2) (ii) (a) (1), the payment due date for a credit card account under an open end (not home secured) consumer credit plan is the date the card issuer is required to disclose on the periodic statement pursuant to § 1026.7 (b) (11) (i) (a).

Ppt Standard Powerpoint Presentation Free Download Id 1517464 The truth in lending act, or tila, also known as regulation z, requires lenders to disclose information about all charges and fees associated with a loan. this 1968 federal law was created to promote honesty and clarity by requiring lenders to disclose terms and costs of consumer credit. the tila standardized the process of how borrowing costs. I. charge card accounts. for purposes of § 1026.5 (b) (2) (ii) (a) (1), the payment due date for a credit card account under an open end (not home secured) consumer credit plan is the date the card issuer is required to disclose on the periodic statement pursuant to § 1026.7 (b) (11) (i) (a). Regulation z is a set of detailed rules that creditors must follow to ensure they provide consumers with clear and accurate information when offering credit. it requires lenders to disclose. Share this page: the truth in lending act (tila) protects you against inaccurate and unfair credit billing and credit card practices. it requires lenders to provide you with loan cost information so that you can comparison shop for certain types of loans. for loans covered under tila, you have a right of rescission, which allows you three days.

Comments are closed.