2024 Used Ev Tax Credit Everything You Need To Know

2024 Used Ev Tax Credit Everything You Need To Know Used clean vehicle credit. beginning january 1, 2023, if you buy a qualified used electric vehicle (ev) or fuel cell vehicle (fcv) from a licensed dealer for $25,000 or less, you may be eligible for a used clean vehicle tax credit. the credit equals 30% of the sale price up to a maximum credit of $4,000. if you do not transfer the credit, it is. The internal revenue service (irs) defines the clean vehicle tax credit for used vehicles as a credit that equals 30% of the sale price up to a maximum credit of $4,000. besides fully electric.

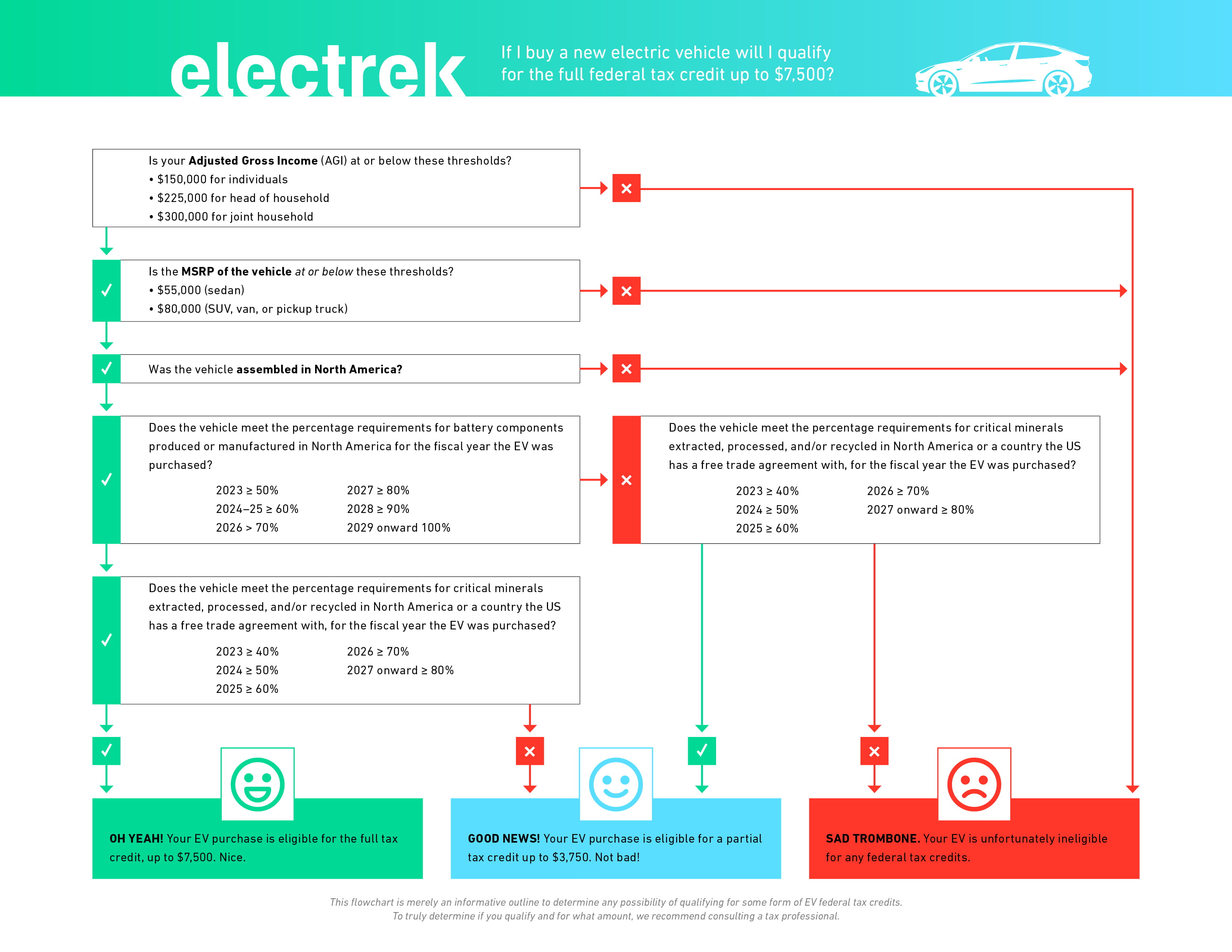

2024 Used Ev Tax Credit Everything You Need To Know 2 9 2024. the ev tax credit offers up to $7,500 back if you purchase a new ev in 2024. but not that many vehicles qualify anymore. not only that, but a host of other changes took place. watch the. Those who buy new electric vehicles may be eligible for a tax credit of up to $7,500, and used electric car buyers may qualify for up to $4,000. new in 2024, consumers can also opt to transfer the. This is a tax credit. this means the $4000 maximum credit on a used vehicle (or $7500 on a new vehicle) reduces your tax bill by that much. to qualify for the federal used ev tax credit, both the car and the buyer must meet certain qualifications. these requirements are set by the federal government under the inflation reduction act. So, now january 1 2023 has passed us by, used electric cars are eligible for their own tax credit. this credit is worth up to $4,000, or 30% of the car's sale price — whichever is lower. however.

Ev Tax Credit 2024 Irs Estel Janella This is a tax credit. this means the $4000 maximum credit on a used vehicle (or $7500 on a new vehicle) reduces your tax bill by that much. to qualify for the federal used ev tax credit, both the car and the buyer must meet certain qualifications. these requirements are set by the federal government under the inflation reduction act. So, now january 1 2023 has passed us by, used electric cars are eligible for their own tax credit. this credit is worth up to $4,000, or 30% of the car's sale price — whichever is lower. however. Written by ronald montoya. 6 21 2011 (updated 4 5 2024) federal ev tax credits in 2024 top out at $7,500 if you're buying a new car and $4,000 if you're buying a used car, while the bank or the. Well, if they do, consider used ones. that's because if you buy a used electric vehicle — for 2024, from model year 2022 or earlier — there's a tax credit for you too. it's worth 30% of the.

2024 Ev Tax Credit List Of Vehicles Written by ronald montoya. 6 21 2011 (updated 4 5 2024) federal ev tax credits in 2024 top out at $7,500 if you're buying a new car and $4,000 if you're buying a used car, while the bank or the. Well, if they do, consider used ones. that's because if you buy a used electric vehicle — for 2024, from model year 2022 or earlier — there's a tax credit for you too. it's worth 30% of the.

Comments are closed.